While the entire economy was hit hard by Covid-19 pandemic, April-June 2021 emerged as the first quarter in the last five that showed a large-scale revival in wage expenses by listed companies, reflecting upward revisions and fresh hiring.

JOBS IN many sectors of India Inc for the quarter-ended June 2021 have seen a sharp rise in wages and salaries, suggesting a revival of sentiments and confidence in a thin slice of the labour market.

While the entire economy was hit hard by Covid-19 pandemic, April-June 2021 emerged as the first quarter in the last five that showed a large-scale revival in wage expenses by listed companies, reflecting upward revisions and fresh hiring.

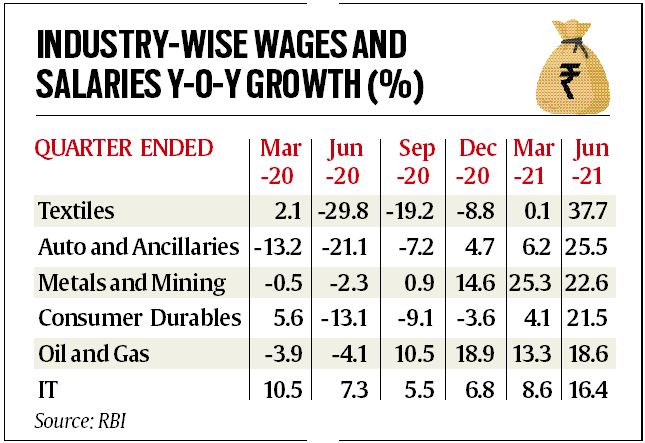

Data of 1,427 listed non-financial companies collated by the RBI and presented in its ‘State of the Economy’ report released on Tuesday, shows that out of 16 key sectors, 11 witnessed double-digit growth in salaries and wages, and four witnessed more than 20 per cent year-on-year growth in the June quarter. These companies account for 86.8 per cent of the market capitalisation of all such companies.

There are, however, some caveats. Experts pointed out that the growth in the quarter-ended June 2021 is over that in June 2020, when a large number of companies had already cut their wage bill following the pandemic hit on businesses. Also, this data is related to listed entities, which are bigger and better positioned to grow and tide over the Covid stress.

The sharp wage rise in listed entities does not mean the pandemic stress on employment is over, or treat there are no more job losses. As The Indian Express reported on August 16, CMIE data shows a disproportionate impact on better quality jobs. Salaried jobs, at 76.5 million in July 2021, were 3.2 million less than in June, notwithstanding the broader economic uptick in July. The July number is also 3.6 million short of the pre-second wave level of 80 million in January-March 2021.

Some experts said the RBI data is indicative of formalisation of the economy where larger companies are benefitting at the cost of companies in the medium and small scale industries. “This trend of higher GST and revenue collection, rise in earnings of listed entities and now increase in salaries and wages bill at these companies is indicative of the faster pace of formalisation in the economy post demonetisation,” said an economist who did not wish to be named.

The RBI data also shows that hiring in the manufacturing and services segments is improving. The Employment Purchasing Managers’ Index (EPMI) suggests that hiring has accelerated in the manufacturing sector. Although the services sector still shows contraction in July 2021, it has improved from the June level. The revival in salaries and hiring comes at a time when “the course of the economy over the month and a half gone by has been altered by the slow retreat of the second wave of the pandemic”, reaffirming the traction that the economy is gaining.

Among the listed companies, though, the RBI report shows that textiles as an industry saw the salaries and wages grow by 37.7 per cent in the June quarter, the auto and auto ancillaries witnessed a 25.5 per cent jump. Metals and mining and consumer durables too saw them grow by 22.6 per cent and 21.5 per cent respectively. IT industry, which did not see a big impact of the Covid-19 pandemic over the last 15 months, also witnessed a jump of 16.4 per cent in its wages and salaries in the quarter ended June 2021.

“Expenses on wages and salaries jumped way above the increases posted in the five preceding quarters, indicative of stepped-up rehiring. Listed companies in two sectors, viz., information technology (IT) and auto and ancillaries, constituted the highest proportion of total wages and salaries paid by all listed non-financial companies. Hiring activity by the three top IT companies are showing signs of an ebullient revival. In contrast, interest expenses fell sharply, reflecting the impact of deleveraging,” said the RBI report.

Even the hotel and tourism segment — the worst sufferers of the Covid pandemic — which witnessed a 35-40 per cent contraction in wages between June 2020 and March 2021, showed an increase of 4.3 per cent in the June 2021 quarter. The 21.5 per cent hike in salaries in the consumer durables segment in the June quarter indicates that the sector which faced a slowdown and sluggish wage bill is on the comeback trail with the revival in consumer spending.

Out of 16 key sectors, 11 sectors saw double digit growth in wages and salaries and not a single industry saw contraction in the same. By comparison, in the quarter ended March 2021, only three industries witnessed double digit growth and two sectors saw contraction in the wage outgo over the corresponding period last year.

The June 2020 quarter was the worst hit and at least 10 industries in the list witnessed contraction in wages and salaries as companies resorted to salary cuts and lay-offs in a bid to survive the stress created by the pandemic.

The report also highlights the growth in earnings for this set of 1,427 companies. It said that in the quarter ended June 2021, net sales of these companies surged by 57 per cent as against a decline of 34 per cent in April-June 2020 when the first wave raged, in spite of anecdotal high-frequency evidence that the second wave took a bigger toll on rural sales than the first wave.

“The y-o-y jump in net sales this year is admittedly suffused with base effects because of the large fall in the corresponding quarter last year; however, even on a sequential basis (q-o-q) that skirts base effects, net sales of these companies declined around 9 per cent, an appreciable improvement over the plunge a year ago. This suggests that with the ebbing of the second wave, demand is limping back towards normal levels, but a catch-up will take some more time,” said the report.

Source: Read Full Article