The accused have, as per initial estimates, collected Rs 50 crore from 20,000 investors from across the country by promising them a return of 4.5 times their investment in 90 days, at a daily interest rate of 11 percent, said police.

The Cyberabad police arrested three men from Delhi on Monday in connection with a massive fraudulent investment scheme floated by two Chinese nationals. The accused have, as per initial estimates, collected Rs 50 crore from 20,000 investors from across the country by promising them a return of 4.5 times their investment in 90 days, at a daily interest rate of 11 percent, said police.

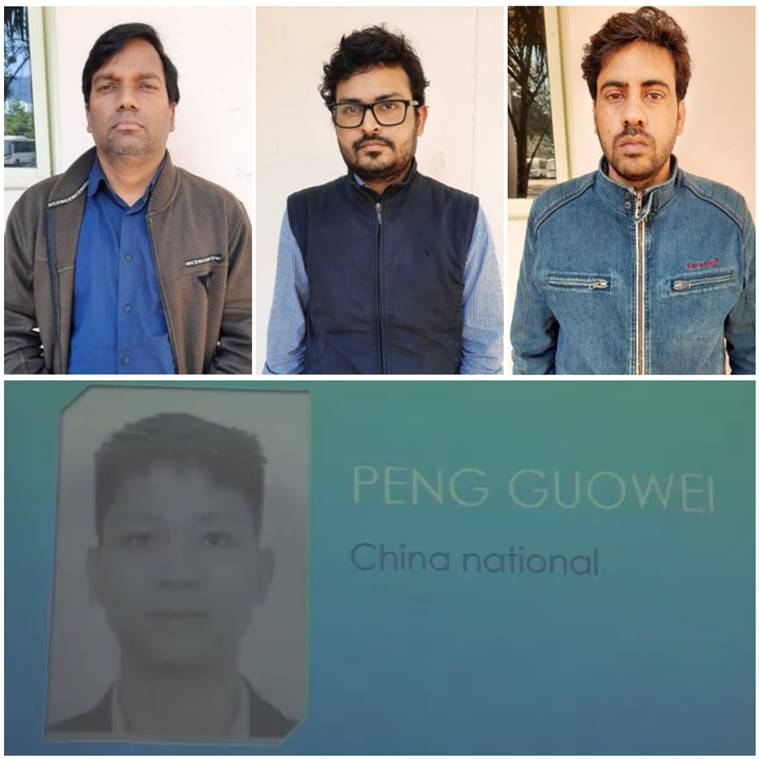

Uday Pratap (41) of Gurgaon, Nitesh Kumar Kothari (36) of Dwarka, and Rajesh Sharma (36) of Gurgaon were arrested by Cyberabad police for enticing the public with huge returns on investments through www.ciciseo.com in the name of ‘Shared Bike (BK)’/ ‘Sharing Economy’. In the market, it is popularly known as Shared BK App. The three accused, police said, were working for Zhang Hongwei alias Peter and Peng Guowei alias Javie, both Chinese nationals who are currently absconding. According to police, Peng Guowei alias Javie left India in January 2020 and did not return due to international travel restrictions whereas Zhang Hongwei never visited India.

Addressing the media, Cyberabad police commissioner VC Sajjanar said that China-based fraudsters are finding newer ways to defraud the public. “In the last one year if you see, it was crypto trading frauds first, then came online betting and online rummy frauds, and the notorious online loan apps, fraud involving some tasks and click links for returns, etc. After websites were blocked and apps dropped, now they are sending such links in .apk files through WhatsApp. ‘Sharing economy’ is the latest fraud,” said Sajjanar.

Through different Whatsapp groups across the country, the accused shared the information about ‘Shared BK/Sharing Economy’ and invited investments or deposits in three schemes which assured 4.5 times returns on the deposits in 90 days. For investments of Rs 300, Rs 3000, and Rs 15,000, one is promised a return of Rs 1350, 13,500, and Rs 67,500, respectively. The investors were lured with a per-day return of Rs 15, Rs 150, and Rs 750. The investors were told that their deposits were being invested in sharing bikes for rent, and the profits would be shared with them as returns on their investments.

The depositors joined the scheme through www.ciciseo.com by providing their personal and bank details. The payments were made through the ‘Razorpay’ payment gateway and an account with a virtual balance was created in the name of the signed up depositors. To gain the confidence of the investors, depositors were paid the return on investments, and once influenced they went on investing in plans of Rs 30,000 and its multiples, said the police commissioner.

The investigation revealed that the deposits were credited to bank accounts of fraudulent Indian companies registered with ‘Razonpay’ payment gateway through various Chinese websites like realmoneyrummy.com, mangakingdom.html, 51cybertel.com, rummytime.cc, rummywish.com, and mirummy.com, etc. The fraudulent companies to which deposits of people were transferred are 1) Bengaluru-based Alidada Technologies Pvt. Ltd. 2) Kanpur-based Ashenfallous Technologies Pvt. Ltd, 3) Kanpur-based Bridge Tera Technologies Pvt. Ltd, 4) Pune-based Cybertel Infotech Pvt. Ltd, 5) Bengaluru-based Geldtech Technologies Pvt. Ltd, 6) Hyderabad-based Mobicentric Technologies Pvt. Ltd, 7) Delhi-based Techdig Fintech Pvt. Ltd, 8) Kanpur-based Toning World International Pvt. Ltd.

The Cyberabad police will coordinate with the RBI, Financial Intelligence Unit, Registrar of Companies (ROCs), Intelligence Bureau, etc to elicit more information about Chinese directors and payment receipts about investments of various China-based companies, apps, and also the involvement of Indian companies and their directors in the fraud.

“The websites are Chinese, the companies are Indian, the bank accounts are maintained in different cities, and the directors are Indians as well as Chinese. Documents are being studied and exact numbers are being assessed,” he said. Representatives of ‘Razorpay’ have been summoned to join the investigations regarding their merchants, he added.

A case is currently registered in the Raidurgam police station, under sections 406 (criminal breach of trust), 420 (cheating) of the Indian Penal Code, and section 5 of Telangana State Protection of Depositors of Financial Establishments Act-1999 against the accused. Police have frozen Rs. 3 cr from 10 bank accounts.

Source: Read Full Article