A certificate of incumbency issued by Trident Trust (BVI) in September 2011 records Thapar as the holder of all 50,000 shares of Musk Holdings Ltd (BVI). In the same year, records show, he acquired Zanha International Ltd (BVI) as its beneficial owner.

An offshore stakeholder in JCT Ltd, which has been declared as a “non-promoter” by the Punjab-based textile giant, is linked to its own chairman and managing director Samir Thapar, records in the Pandora Papers investigated by The Indian Express reveal.

This offshore entity is registered in the British Virgin Islands, where Thapar is also the beneficial owner of another company, the records show.

https://youtube.com/watch?v=WS_9w9-H2jI%3Fversion%3D3%26%23038%3Brel%3D1%26%23038%3Bshowsearch%3D0%26%23038%3Bshowinfo%3D1%26%23038%3Biv_load_policy%3D1%26%23038%3Bfs%3D1%26%23038%3Bhl%3Den-US%26%23038%3Bautohide%3D2%26%23038%3Bwmode%3Dtransparent

A certificate of incumbency issued by Trident Trust (BVI) in September 2011 records Thapar as the holder of all 50,000 shares of Musk Holdings Ltd (BVI). In the same year, records show, he acquired Zanha International Ltd (BVI) as its beneficial owner.

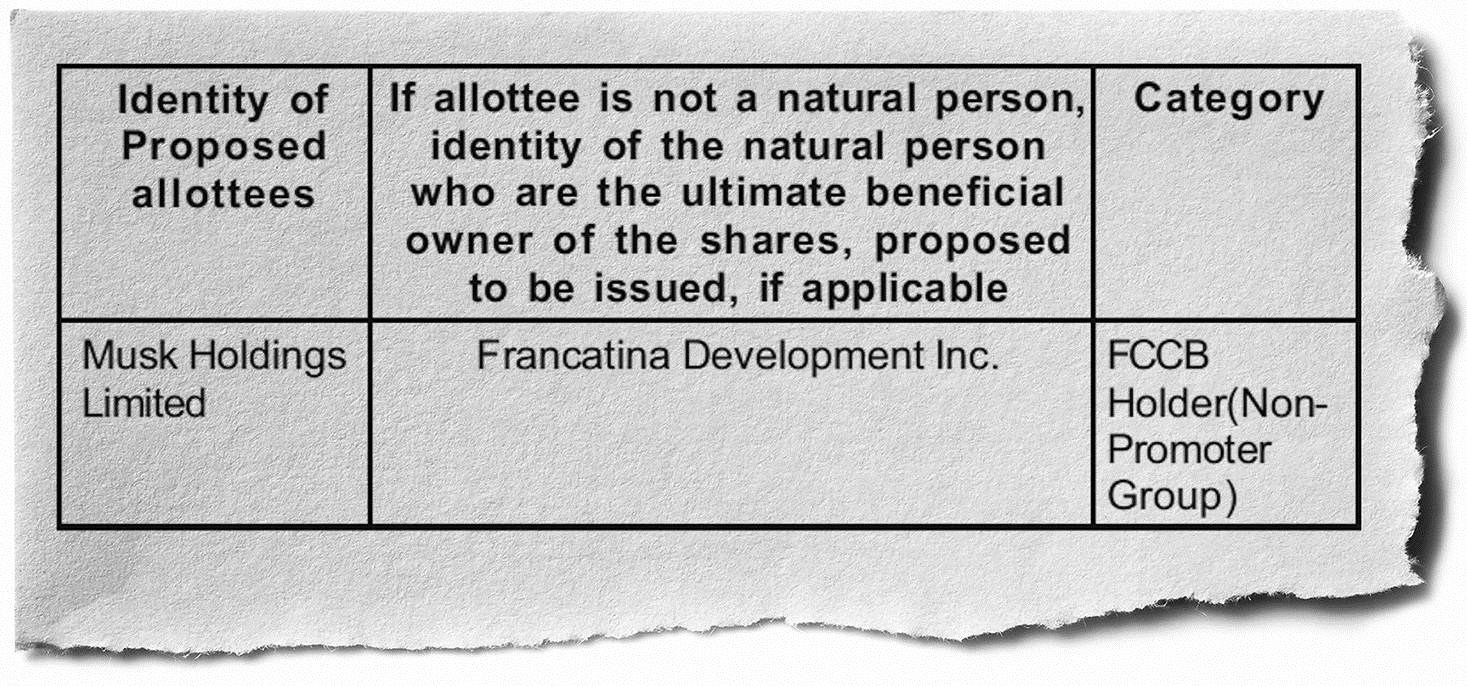

Set up in 2009, Musk Holdings has stake in JCT Ltd and is listed as a “non-promoter” in official records of the company, including annual reports and RoC filings.

According to JCT records, Musk Holdings was allotted a 7.94 per cent stake in JCT Ltd in 2013-14. While records in Pandora Papers list Thapar as the sole shareholder of Musk Holdings, JCT’s official documents identify “non-promoter” Francatina Development Inc as the ultimate beneficial owner.

Company records and The Indian Express investigation of records in the Panama Papers, leaked in 2016, show that Francatina Development was linked to another BVI company, Alport Ltd, which also held a “non-promoter” stake in JCT Ltd.

Alport Ltd was allotted a 4.79 per cent stake in JCT Ltd in 2015-16. In 2012, the shares of Alport were held by Francatina Development.

Records in Panama Papers of the now-defunct Panamanian law firm Mossack Fonseca list a Singapore address for the administrative office of Alport. The same address is listed in JCT records for Thapar’s Musk Holdings.

🗞️ Read the best investigative journalism in India. Subscribe to The Indian Express e-Paper here.

According to Mossack Fonseca records, the address belongs to Orbis Advisory. Operating from offices in Switzerland, Singapore and Liechtenstein, the Orbis Group “specialises in structured transactions” to find “tailor-made solutions for protecting, maintaining and increasing” client assets.

The Orbis Group figured prominently in the Income-Tax case against meat exporter Moin Qureshi, where investigators identified Orbis Consulting Trust (Liechtenstein) as the ultimate beneficial owner of Francatina Development Inc.

In the case of Zanha International Ltd, the BVI company acquired through wealth management services provider Mirabaud (Dubai), Thapar is listed as the beneficial owner. “BO has a liability on his company which for liquidation purposes needs to be segregated to a BVI company and subsequently the debt will be written off and the company/structure will be put into voluntary liquidation,” records state.

For funds, Thapar listed three sources: inherited property and cash from grandfather; recently sold a property for USD 8 million in Zone 1 of Lutyens Delhi; salary as well as dividends from JCT.

In 2015, Zanha International was struck off the Registry for non-payment of licence fees. Records show that discussions were held in 2017 to restore the company for a fee of $5,725. The outcome remained unclear.

Reached for comment, Thapar sought time until September 30 but, subsequently, did not respond to queries from The Indian Express.

One of India’s leading manufacturers of textiles and filament yarn, JCT reported a total income of Rs 207.44 crore during the quarter ending March 31, 2021 as compared to Rs 191.28 crore in the previous quarter ending December 31, 2020, while its net profit fell from Rs 10.49 crore to Rs 5.71 crore between the two quarters.

Source: Read Full Article