From Bakul Nath, the NRI son of Congress veteran and former Madhya Pradesh Chief Minister Kamal Nath, to case accused Rajiv Saxena, these records provide fresh evidence in the corruption scandal which has had the CBI and ED filing several chargesheets.

Key persons indicted in the controversial AgustaWestland helicopter deal figure in the Pandora Papers because of their offshore networks and alleged money flows, an investigation of records by The Indian Express has revealed.

From Bakul Nath, the NRI son of Congress veteran and former Madhya Pradesh Chief Minister Kamal Nath, to case accused Rajiv Saxena, these records provide fresh evidence in the corruption scandal which has had the CBI and ED filing several chargesheets.

BAKUL NATH: His name figured in the interrogation report of Rajiv Saxena who is currently on bail. Case records show that Saxena, in alleged collusion with Delhi-based lawyer Gautam Khaitan, received Euro 12.40 million in the account of Interstellar Technologies from AgustaWestland. This was allegedly laundered further to pay other middlemen and public servants.

By 2000, Saxena had taken over 99.9% of the shares of Interstellar Technologies.

https://youtube.com/watch?v=WS_9w9-H2jI%3Fversion%3D3%26%23038%3Brel%3D1%26%23038%3Bshowsearch%3D0%26%23038%3Bshowinfo%3D1%26%23038%3Biv_load_policy%3D1%26%23038%3Bfs%3D1%26%23038%3Bhl%3Den-US%26%23038%3Bautohide%3D2%26%23038%3Bwmode%3Dtransparent

During his interrogation (reported in The Indian Express in November 2020), Saxena said: “We (he and co-accused Sushen Mohan Gupta) received bridge funding through Pristine River Investments, a company managed by John Docherty for Bakul Nath, son of Kamal Nath. Thus, indirectly funds from Interstellar Technologies were used to repay the loans from Pristine River Investment.”

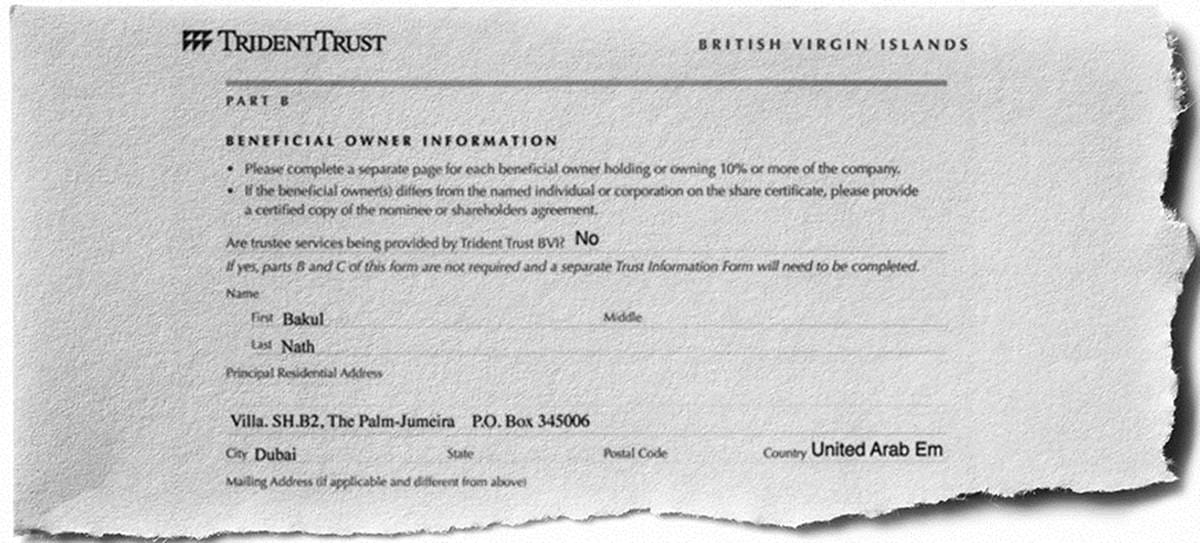

The Pandora Papers records show that Swiss national Docherty is linked to Bakul Nath via an offshore company set up in February 2018 by Trident Trust.

This British Virgin Islands company is Spector Consultancy Services Ltd and names Docherty as its first Director and Bakul Nath as the Beneficial Owner with a Dubai address.

Another BVI company, Cellbrook Limited, is listed as a shareholder of Spector Consultancy Services. Owning real estate is listed as the “purpose” of this company and its assets in the first three years are pegged at $10 million.

Bakul Nath did not respond to queries from The Indian Express.

RAJIV SAXENA: Records show AgustaWestland case accused Saxena set up a trust in 2014 for personal assets with its underlying company in the BVI being Tanay Holdings Limited, linked to shares or ownership of 14 other companies or assets.

These include shares of his villa in Palm Jumeirah, a flat in London, two property companies and two offices. The Tanay Trust has another underlying company in Belize called Tanay Holdings Ltd which controls accounts in banks in Zurich, including UBS Bank and Credit Suisse.

Also, in 2014, Saxena’s business trust, Matrix UAE Trust, was set up as an offshore venture and its “underlying” BVI company was Matrix International Limited. Shares of several of Rajiv Saxena’s flagship companies — some linked to the AgustaWestland kickbacks — were to be pledged to the trust.

🗞️ Read the best investigative journalism in India. Subscribe to The Indian Express e-Paper here.

In early 2014, the AgustaWestland deal was cancelled by the Indian government. The Saxenas were first linked to it in 2017 when Shivani Saxena was arrested at Chennai airport.

Months before her arrest, in confidential emails, Rajiv Saxena gave instructions to Trident Trust to “urgently” liquidate the structures of Tanay Trust and the Matrix UAE Trust as well as their connected BVI companies and transfer the shares to their Settlor, Rajiv Saxena.

An email of May 2016 stated: “The client now wants the Trusts to be struck off as well as the underlying companies as they no longer want to formally dissolve them… We have advised them that the Trusts cannot be terminated in this manner, but they are insistent that they can.” Similar instructions were given by Rajiv Saxena to dissolve Mountwood Limited, another BVI company incorporated in 2014 via the Trident Trust.

Rajiv Saxena did not respond to queries from The Indian Express.

GAUTAM KHAITAN: The Delhi-based lawyer was key to the complex money laundering structure put in place for the AgustaWestland deal and was arrested in December 2016 along with former Indian Air Force Chief S P Tyagi. He is now out on bail.

Records show that Gautam Khaitan acted as the Protector in offshore Trusts for Aditya Khanna, the London-based restaurant owner who was named in the Volcker report on the oil-for food Iraq scandal, and Radhe Shyam Saraf, owner of Hyatt Hotel in New Delhi and the Yak & Yeti Hotel in Kathmandu. The trust he set up for Saraf is called Varunisha Trust.

https://youtube.com/watch?v=b0-tNIp4nrM%3Fversion%3D3%26%23038%3Brel%3D1%26%23038%3Bshowsearch%3D0%26%23038%3Bshowinfo%3D1%26%23038%3Biv_load_policy%3D1%26%23038%3Bfs%3D1%26%23038%3Bhl%3Den-US%26%23038%3Bautohide%3D2%26%23038%3Bwmode%3Dtransparent

In the case of Aditya Khanna, Gautam Khanna appears as the “professional intermediary” for the Glacier Trust incorporated by Trident Trust in BVI. The company, through a complex structure, holds restaurants in London — Tamarind and Imli.

Responding to queries, Gautam Khaitan said: “Both my clients mentioned by you have been NRIs for decades. I was a professional intermediary for them and only they can tell if the companies are active or not.”

Aditya Khanna said: “I have been a NRI literally all my life since 1983. I used the services of Trident to help me set up the Glacier Trust in 2012. The trust was set up to hold shares in Fritton BVI which was a company owned by my late father to hold shares in his UK food business that I inherited from him. The net worth of the trust, corelated to the value of the restaurants at that time, could be $3.5 million, if not more. I never actually ended up using this structure which was then shut down in 2013. Their existence at that time was disclosed to the UK tax authority /HMRC, and the Indian authorities are aware of this too.’’

Radhe Shyam Saraf said: “I have been a Non-Resident Indian for more than five decades. I would appreciate your understanding that planning my wealth is a personal and private matter.’’

DEV MOHAN/ SUSHANT GUPTA: The Guptas are among families involved in the defence business in India. In the AgustaWestland deal, Dev Mohan Gupta’s son, Sushen Mohan Gupta, was one of the accused. Their company, Defsys Solutions Pvt Ltd, was also named in the AgustaWestland and Rafale contracts.

The Pandora Papers records show that in 2005, Dev Mohan Gupta set up the Lange Trust in tax haven Belize. The records name Dev Mohan Gupta as Settlor and his wife Shubra Gupta and son, Sushant Mohan Gupta, as the first and second beneficiaries. There are no specifics on the value of assets. In 2011, Dev Mohan Gupta signed a revocation deed for the Lange Trust.

Dev Mohan Gupta’s lawyer Nirvikar Singh said: “My clients have no comments to offer on this matter.”

Source: Read Full Article