‘Rising Covid cases and localised lockdowns are being closely monitored.’

The markets have entered FY22 after a stellar run in the year gone by. Abhinav Khanna, head of equity at Citi India, tells Puneet Wadhwa that India remains a preferred investment destination for foreign institutional investors.

What’s your market outlook for the next few months? Do the risks outnumber the factors?

We see a limited upside for the global markets, including India, in the near term, primarily due to stretched valuations.

However, the macroeconomic and corporate earnings recovery in FY22 will be material.

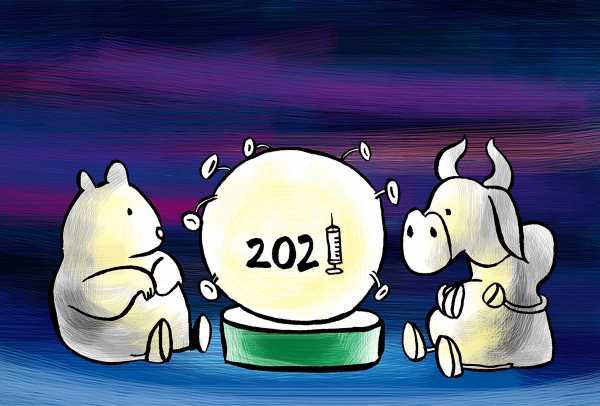

While the fresh surge in Covid cases is a concern, lower mortality rates, the ramping up of vaccinations, and supportive government policies will be mitigating factors.

Our proprietary global ‘Bear Market Checklist’ is suggesting ‘buy on dips’.

Where do you see the Sensex and Nifty by December?

Our Nifty target for December is 14,800.

A continued rise in commodity prices, elevated FY22E consensus growth expectations (over 30 per cent earnings growth forecast), and valuations in excess of 21x FY22E EPS (earnings per share) are risks, in our view.

Hence, we recently tweaked our model portfolio positioning to be a bit more defensive.

How are you dealing with the rise in bond yields?

Unprecedented fiscal and monetary expansion globally led to expectations that inflation will likely overshoot the central bank targets, forcing it to tighten monetary policy earlier than expected.

Due to this, US 10-year nominal yields jumped to 1.6-1.7 per cent vs 1 per cent as of end-January, and versus August-lows around 0.5 per cent.

Our US rates team recently revised its 2021 forecast to 2 per cent (vs 1.45 per cent earlier).

The house view is that the US Federal Reserve will taper off asset purchases in the fourth quarter of 2021 and that stronger core inflation will lead to a late 2022 rate hike.

This is negative for equity markets, especially for expensive growth stocks, but should favour the financials that will benefit from rising yields.

Do you think the markets will eventually learn to co-exist with higher yields and look at economic and corporate earnings growth instead?

If the rise in yields is orderly and reflects the economic recovery along with normal levels of inflation, higher yields and the markets can co-exist.

While there are different views on the Street regarding how long the yields can rise, in our view it is unlikely that the US Fed will let US real yields rise much above zero per cent.

What should the strategy be for commodity-related stocks?

We have made substantial upgrades to metal prices for 2021 on the back of stronger-than-anticipated consumption growth, particularly ex-China, which is running at rates we had not expected until 2022-23.

We see real prospects for a super cycle in copper and aluminium, as we see strong decarbonisation-led factors to keep inventories low despite an eventual turn in the global cycle.

Once OPEC+ supply returns, crude oil prices should fall back to $40-$55.

Resilient commodity prices, driven by strong demand and rotation to value driven by rising bond yields, make us positive on the commodity-related sectors/stocks.

To what extent are the markets factoring in the possibility of lower-than-expected FY22 earnings growth as input costs rise?

For FY22E, we estimate Nifty earnings per share growth to be over 32 per cent, which may eventually end up being quite optimistic.

That said, looking at the consensus Nifty FY22E EPS trends YTD, it is fair to say that we haven’t seen any major downgrades yet.

This could be a negative surprise once the companies start to report their fourth-quarter earnings for FY21 and give commentary on price hikes/margin implications.

However, historically rising commodity prices are not necessarily detrimental to corporate earnings (at least initially), given the impact on each sector is different.

If the demand environment is good, notwithstanding sporadic Covid-led lockdowns, firms should be able to pass on the cost increases.

Overweight and underweight sectors…

Our global equity strategist recommends energy, materials, and financials as overweight and information technology, consumer discretionary, and communication services as underweight in an environment of rising real yields.

In our standard portfolio, he is overweight on EMs.

In terms of India positioning, we are overweight on financials, industrials, and real estate while consumer staples is our key underweight.

What are the key concerns of FIIs with respect to India?

India remains a preferred investment destination for FIIs.

One key supportive factor earlier this quarter was the Budget, which was very well received by them, especially with respect to the intent (credible math, growth focus, no new taxes).

However, rising Covid cases and localised lockdowns are being closely monitored.

Source: Read Full Article