While the likelihood of these states going the Lanka or Greece way may be an alarming assessment, the financial situation of some states such as Punjab and West Bengal is indeed quite weak.

Several top bureaucrats are reported to have briefed Prime Minister Narendra Modi that some states could become like cash-strapped Sri Lanka or Greece due to the freebies they have announced.

The bureaucrats are reported to have said that announcements made by Punjab, Delhi, Telangana, Andhra Pradesh and West Bengal are unsustainable.

While the likelihood of these states going the Lanka or Greece way may be an alarming assessment, the financial situation of some states such as Punjab and West Bengal is indeed quite weak.

Let us examine the financial position of the states cited above by the bureaucrats, along with that of a few BJP-ruled states, to make it a balanced assessment.

Punjab

The Aam Aadmi Party rode to power in Punjab on the promise of various freebies, such as Rs 1,000 a month to each female aged over 18 years, and free electricity of 300 units to domestic users.

While cash doles of Rs 1,000 to each female aged over 18 years may cost the state over Rs 12,000 crore (Rs 120 billion) a year, it is difficult to gauge how much the free power would cost, as the government may raise rates for those using more than 300 units, partly offsetting the hit to the coffers.

If this isn’t done, the freebie may cost the state exchequer another Rs 5,000 crore (Rs 50 billion) a year.

What makes these promises look unsustainable is the demand Chief Minister Bhagwant Mann made at a meeting with Modi a few days after assuming charge.

He asked for a Rs 50,000-crore-a-year (Rs 500 billion) package for two years.

Though this wasn’t the first time a chief minister was seeking a special package for his state, Punjab’s weak financial position brings into focus the freebies announced by AAP.

It should be noted that Punjab is a highly indebted state of the country.

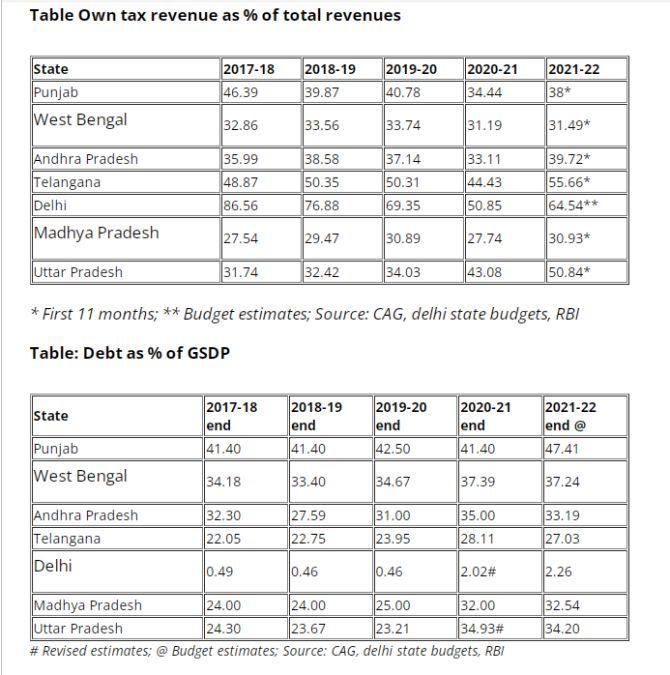

Its debt is projected to constitute almost half its gross domestic product in the Budget estimates for 2021-2022, which is the highest in the country.

Meanwhile, the AAP government also presented an interim Budget for the first three months of FY23.

Of the total expenditure of Rs 37,000-odd crore (Rs 370 billion), the largest portion of around Rs 4,800 crore (Rs 48 billion) will be spent on servicing its debt.

According to accounts vetted by the Comptroller and Auditor General of India, Punjab spent just five per cent of its debt on capital expenditure during 2018-2019, indicating that the rest of the public debt was used for non-development purposes.

If the freebies are really implemented, the portion of capital expenditure may go down further.

Delhi

Also ruled by AAP, Delhi’s financial position isn’t as shaky as that of Punjab.

Its debt as proportion to the gross state domestic product (GSDP) is less than 2.5 per cent and that too when Covid-induced lockdowns forced it, along with other states, to ask the Centre to borrow from the market on its behalf.

Otherwise, its debt constituted less than 0.5 per cent of its GSDP in earlier years.

Despite freebies implemented by the government, such as 200 units free for domestic users, free travel in state-run buses, free water up to 20,000 litres a household a month, it expects to be in revenue surplus to the extent of Rs 7,601 crore (Rs 76.01 billion) in the current financial year.

However, in the previous financial year, it projected a revenue surplus of Rs 1,271 crore (Rs 12.71 billion), but revised estimates have put it at a revenue deficit of Rs 3,039 crore (Rs 30.39 billion) or 0.33 per cent of its GSDP.

The Delhi government is projected to take a hit of Rs 3,250 crore (Rs 32.50 billion) for providing free electricity and Rs 600 crore (Rs 6 billion) for providing free water as cited above during the current financial year.

The state’s fiscal deficit was just Rs 14,562 crore (Rs 145.62 billion) during 2021-2022 (RE) or 1.58 per cent of its GSDP.

However, this should be taken with a pinch of salt.

According to PRS Legislative Research, Delhi has been underspending on capital outlay.

During 2015-2020, its underspending on capital outlay was 40 per cent as compared to an average of 17 per cent by all states.

Delhi expects its fiscal deficit to further come down to Rs 9,194 crore (Rs 91.94 billion) during 2022-2023 despite a 35 per cent increase in capital outlay to Rs 12,386 crore (Rs 123.86 billion) from the revised estimates of Rs 9,183 crore (Rs 91.83 billion) during 2021-2022.

West Bengal

The Mamata Banerjee government announced Krishak Bandhu, which is seen as counter to the Centre’s PM-Kisan.

This and various other freebies have put a hole in the finances of the state, which along with Punjab and Kerala, is the highest indebted in the country.

Its debt constitutes more than a third of its GSDP, while its OTR accounts for less than one-third of its total receipts during most of the recent years.

As much as Rs 4,994 crore (Rs 49.94 billion) has been allocated towards the Krishak Bandhu scheme for the current financial year, Rs 1,930 crore for mid-day meal scheme, Rs 2,117 crore (Rs 21.17 billion) for Smagra Shiksha Abhiyan.

These three schemes alone constituted almost 10 per cent of the total OTR at Rs 79,347 crore (Rs 793.47 b=illion) for the year.

The governments usually run fiscal deficits and borrow funds for capital/assets formation or for creation of economic and social infrastructure, so that assets created through borrowings could pay for themselves by generating revenue.

It is desirable to fully utilise borrowed funds for the creation of capital assets, and to use revenue receipts for the repayment of principal and interest.

The state government, however, spent only 17 per cent of the borrowings on capex during 2020-2021, according to the CAG study of its accounts.

As much as 83 per cent of the public debt was used to repay the principal and interest on public debt of previous years, to meet periodic shortfalls of revenues against expenditure, to maintain a positive cash balance at the end of the year and to invest in treasury bills, the report said.

In 2021-2022, capital outlay by West Bengal is expected to be 41 per cent lower than the budget estimates.

As per revised estimates, capital outlay on rural development, welfare of SC, ST, OBC and minorities, and education, sports, arts

and culture is pegged to be lower than budget estimates by 84 per cent, 79 per cent, and 66 per cent, respectively, according to PRS.

Other sectors that have seen significant reduction in capital outlay are social welfare and nutrition (64 per cent) and police (60 per cent).

Further, with the state being in revenue deficit, it may reduce the fiscal space for capital outlay, PRS said.

Telangana

The state ruled by TRS runs various welfare schemes such as Rythu Bandhu etc.

However, the state finances are not weak unlike Punjab and West Bengal’s.

Its debt-to GSDP ratio rose due to Covid-induced lockdowns and the consequent borrowings, in the recent years but it was still under 30 per cent.

Its OTR constitutes almost or over half of its total receipts, except during the Covid-impacted 2020-2021.

It is projected to spend almost Rs 15,000 crore (Rs 150 billion) on Rythu Bandhu which is agriculture investment support scheme during 2022-2023.

The scheme, introduced from the year 2018-2019 Kharif season to take care of initial investment needs of every farmer, is provided by way of grant of Rs 5,000 per acre per season for purchase of inputs like seeds, fertilisers, etc twice a year.

This was the first direct farmer investment support scheme in India, where the cash is paid directly.

It runs a host of other schemes.

Even then, the state had a revenue surplus of Rs 4,395 crore (Rs 43.95 billion) or 0.38 per cent of GSDP during 2021-22.

Revenue surplus is projected to decline 15 per cent to Rs 3,755 crore (Rs 37.55 billion) during the current financial year.

It spent 56 per cent of its borrowed funds on capital expenditure during 2020-2021,according to CAG.

Andhra Pradesh

Unlike states such as West Bengal and Telengana, the YSR Rythu Bharosa is not a programme to counter the Centre’s PM-Kisan, but to supplement it.

The two schemes give Rs 13,500 in three installments to a farmer, even if he is a tenant, in a year.

The scheme is projected to cost the state exchequer Rs 3,900 crore (Rs 39 billion) during 2022-2023.

This is about 13 per cent of the capital outlay of the state for the year.

Then, there is the Smagra Shiksha Abhiyan which has been allocated Rs 2,136 crore (Rs 21.36 billion).

Other schemes include housing for all, Arogyasri, YSR Jalayagnam, Amma Vodi, YSR Asara, and YSR Cheyuta.

The state’s financial situation is not as weak as that of Punjab or West Bengal’s.

Its OTR constitutes at least a third of its total receipts over the years.

Its debt constitutes around one-third of its GSDP in recent years due to Covid-hit on revenues but in earlier years it was less than one-third.

So far as borrowed funds are concerned, all of it is not spent on asset creation.

However, the state spent 36 per cent of its borrowed funds on capital expenditure during 2020-2021, according to CAG.

This is worse than Telangana, but better than Punjab and West Bengal’s.

Madhya Pradesh

The state also runs a scheme for supporting farmers investments — the Mukhymantri Kisan Kalyan Yojana.

Under the scheme Rs 4,000 is given to a farmer in two installments in a year.

This supports the Centre’s PM Kisan scheme.

The state government projected to allocate Rs 3,200 under the scheme for 2022-2023.

Besides, Rs 3,908 crore (Rs 39.08 billion) would be spent on the Smagr Shiksha Abhiyan, Rs 1,500 crore (Rs 15 billion) for housing for all among others.

The state’s debt has been less than a third of its GDP even during Covid times.

However, its OTR contributed less than a third to its overally revenue kitty.

It spent 85 per cent of its borrowed funds on capital expenditure in 2019-2020.

However, that got reduced to 45 per cent during Covid-affected 2020-2021.

Nevertheless, it was better than states such as West Bengal, Punjab and Andhra Pradesh.

Uttar Pradesh

After winning the elections, the Yogi Adityanath government extended the free ration scheme in the state for three months till June 30 this year.

The scheme provides for an additional five kg of food grain per household per month.

It supports the Centre’s free ration scheme for the poor, implemented in 2020 when the pandemic struck.

The state government will spend Rs 3,270 crore (Rs 32.70 billion) that will benefit up to 150 million people during these three months.

The government distributed over 1.4 million tonnes (MT) of wheat, 0.95 MT of rice, 0.10 MT of chana (gram), 101.9 million litres of soybean oil and 100,000 tonnes of salt as free ration during three months leading up to the assembly elections. This was part of the Covid relief package.

The distribution of soybean oil, salt and chana, was in addition to the free foodgrain distributed through the Public Distribution System (PDS) under the Centre’s National Food Security Act (NFSA) and also the Pradhan Mantri Gareeb Kalyan Ann Yojana (PMGKAY).

Ration was distributed twice a month, once when just grains were sold and for a second time when the remaining items were distributed.

The BJP also promised a host of freebies in its election manifesto for the UP assembly elections including free electricity for irrigation for farmers, two free LPG cylinders (one each on Holi and Diwali) under the Ujjwala Yojana scheme, free public transport travel for women over 60, and free two-wheelers for female college students.

However, the state is in a sound financial situation.

Its OTR has been contributing almost one-third of its total receipts.

In fact, OTR accounted for 43 per cent of total revenues during the Covid-affected 2020-2021 and over half of total receipts in the first eleven months of 2021-2022.

Its debt has been under control and has risen to over one-third of GSDP only during the Covid affected 2020-2021 and 2021-2022.

With revenues sound, this means that it is the rising expenditure that has forced the state to borrow more.

Its track record on quality of expenditure from borrowed funds is quite sound.

For instance, the state government borrowed Rs 73,808.69 crore (Rs 738.08 billion) during 2019-2020 and spent Rs 62,118.03 crore (Rs 621.18 billion) on capital expenditure or 84.16 per cent of the debt was spent on generating assets, according to CAG assessment.

Feature Presentation: Aslam Hunani/Rediff.com

Source: Read Full Article