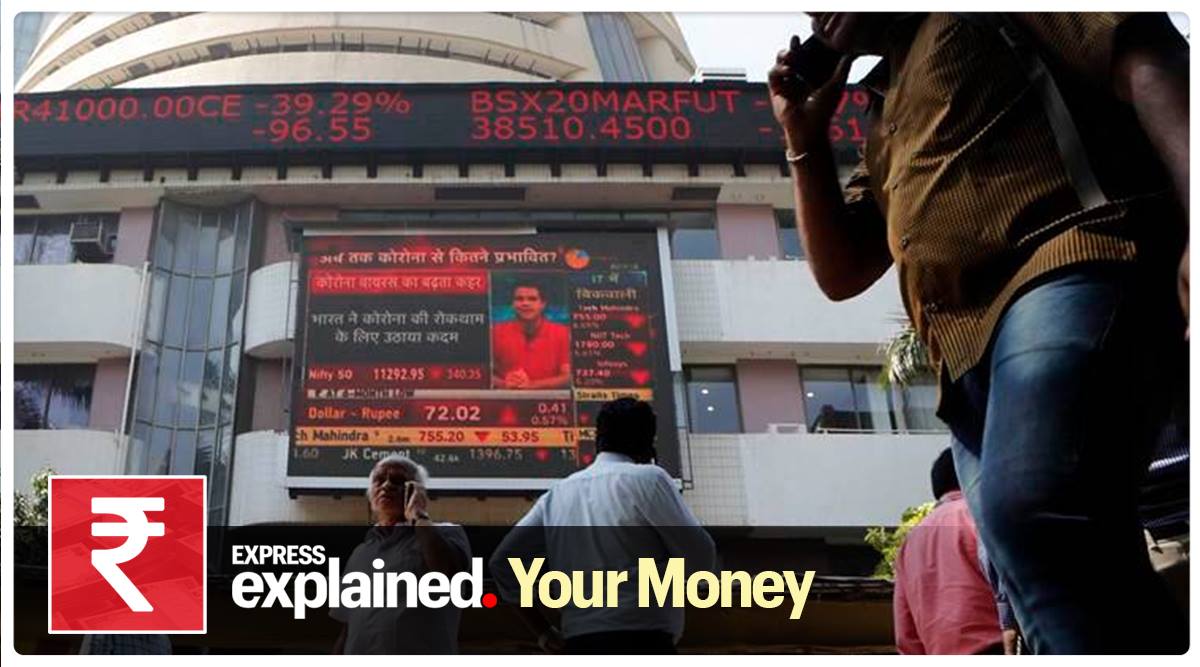

There are growing concerns over rising Covid-19 cases across several countries and the global economic recovery, stretched valuations in equity markets, outflows by foreign portfolio investors, and anxiety over the Budget to be presented on Feb 1.

The Dow Jones Industrial Average, the premier index in the United States, fell over 2 per cent on Wednesday, as the Federal Reserve underlined its commitment to providing support to the American economy. Indian indices too fell 1.1 per cent; over the last five trading sessions, the benchmark Sensex at BSE has lost 2,918 points or 5.9 per cent.

There are growing concerns over rising Covid-19 cases across several countries and the global economic recovery, stretched valuations in equity markets, outflows by foreign portfolio investors, and anxiety over the Budget to be presented on Feb 1.

What did the Fed say?

After its first meeting after Joe Biden became President, the Federal Open Market Committee (FOMC) under the chairmanship of Jerome H Powell said it will maintain an accommodative stance on monetary policy, and keep interest rates between 0 and 0.25 per cent. The Fed will continue to buy treasury securities worth $80 billion and mortgage backed securities worth $40 billion every month, injecting a monthly aggregate $120 billion into the economy to support the flow of credit to households and businesses.

Why did the markets fall?

While the Fed is likely to continue with the stimulus programme until 2023, there are concerns that the markets are running ahead of economic fundamentals, and are driven by liquidity. There are also worries over the Covid curve and pace of vaccination in the US.

“The pace of recovery in economic activity and employment has moderated in recent months, with weakness concentrated in the sectors most adversely affected by the pandemic,” the FOMC statement said. “The ongoing public health crisis continues to weigh on economic activity, employment, and inflation, and poses considerable risks to the economic outlook.”

There are also concerns of a bubble, as stocks of several companies are rallying irrespective of their business fundamentals. On Wednesday, shares of GameStop Corp and AMC Entertainment jumped 130 per cent and 300 per cent respectively. GameStop shares have risen 15 fold over the last 10 trading sessions on account of what is called ‘short squeeze’ – in which short sellers who had placed their bets on a stock to fall, rush to hedge their positions or buy the stock in case of an adverse price movement, leading to a sharp rise in prices.

What is impacting the Indian markets?

Indian markets fell for the fifth straight trading session on Thursday. The Sensex, which fell 1.13 per cent on Wednesday, has declined 5.8 per cent over the last five trading sessions. While the fall has been in line with global markets, many feel the correction was expected after the strong rally over the last two months. If expensive valuations have been discomforting for some investors, profit booking is being cited as a major reason for the correction.

Participation by foreign portfolio investors (FPIs), who have contributed the most to the market rally, has weakened in the last few days, adding to the sense of gloom. The outflow has not been huge in itself – while the net inflow for January stands at Rs 23,254 crore, FPIs have sold net holdings worth Rs 1,206 crore over the last three trading sessions. But in the absence of strong domestic institutional investor (DII) participation – investors have been booking profits – the FPI outflow led to a sharp fall in markets.

Market participants said several large investors are waiting to see the government’s impetus to the economy in the Budget before taking fresh positions. “We generally see some weakness in the market ahead of the Budget (when there has been a rally) as several investors book profits. They will now wait for the Budget announcements…,” said a fund manager with a leading fund house.

So, will the markets remain weak, or will they rise again?

“Unless there is a reversal in global liquidity flow, I do not see any reason why the market should go down,” said CJ George, MD, Geojit Securities. Many others agree that if easy monetary policies continue globally, the markets will continue to rise – and the continuation of the stimulus programme by the Fed aids that.

George added that the low interest rate environment heats up both the markets and the economy as the cost of capital goes down, and that has the potential to take things forward. “The first change should happen on the consumption side – and if that rises and people start spending, then the Capex cycle will also start,” he said.

The Budget can play a key role in long-term structural positivity for the economy and markets. Experts feel that the Budget may set the tone for this; however, if it disappoints, the correction may be extended.

Some experts feel that the correction is being seen in stocks that had rallied significantly, and it isn’t a cause for concern. “A correction of 5-10 per cent after a strong rally is healthy, and it has been in line with the global weakness. I don’t think there is too much to worry about this correction,” said Pankaj Pandey, head of research at ICICIdirect.com. Pandey added that an improvement in GST collections and tax-to-GDP ratio will provide impetus to the markets.

Over the last five days, while the Sensex fell 5.8 per cent, mid and small cap indices fell 4.9 per cent and 3.8 per cent respectively. This indicates that the correction has been more in large cap stocks, that rallied a lot in a quick time.

There are also hopes of Capex revival alongside rising capacity utilisations. Analysts say the cement sector, which has seen capacity utilisations cross 80 per cent, is likely to see the beginning of the Capex cycle in three to six months – something that could be witnessed in other sectors too, as demand and consumption grow. “The last infra cycle was seen when interest rates were low. Even now, rates have gone down significantly, and we can witness an uptick in economic activity,” said Pandey.

Many feel that real estate and construction will be a big mover for the economy going forward. Nilesh Shah, MD & CEO, Kotak Mahindra AMC, said, “Stars are aligned for revival of India’s housing and construction sector, which is key for India’s growth as it has the ability to lift a large segment of the economy. Low interest rates, improvement in affordability, cut in stamp duty, decline in inventory, and need for homes for all will ensure faster growth for the housing sector. It may start contributing 1 percentage point to the GDP going forward.”

Is there reason for caution?

Indeed, some are advocating caution. “Unless I see a rise in real consumption, I won’t be too convinced with the rally. The liquidity flow has to be backed by a rise in economic activity, which includes consumption and investment,” said the head of a financial services firm who did not wish to be named.

Also, given that the recovery has led to market share moving from unorganised sectors to organised sectors, many feel that India needs to ensure there is inclusive growth. While the movement of business to the organised segment will help lift GST collections, it will impact the micro, small and medium enterprises, which are the biggest generators of employment.

Source: Read Full Article