Before you invest, check the fund manager’s track record in managing such a strategy, asserts Sarbajeet K Sen.

Among debt funds, the category that enjoys the mandate to invest anywhere is the dynamic bond fund.

It can invest in high or low-duration bonds, or in high or low-credit quality papers.

With interest rates likely to harden, investors who are not sure about which debt fund category to invest in for a slightly longer time horizon can consider dynamic bond funds, a category with assets under management (AUM) of Rs 25,611 crore at the end of June.

Rates could harden

Fund managers feel interest rates could rise.

“We believe interest rates have bottomed out and could gradually head higher,” says Manish Banthia, senior fund manager, ICICI Prudential Asset Management Company.

Joydeep Sen, author and corporate trainer (debt market), holds a similar view.

“At some point of time, the Reserve Bank of India will have to change its stance from ultra-supportive to supportive. Interest rates are expected to move mildly upward from here,” he says.

Need for active management

Banthia believes the current environment calls for active management of the portfolio.

“The yield curve is very steep currently. As we move towards rate normalisation, the curve will become much flatter. Therefore, losses at the shorter end of the curve could be higher than at the longer end. That is why there is a need to manage duration risk actively,” he says.

Sen says the portfolio maturities of most dynamic bond funds are not aggressive at present in anticipation of hardening of rates.

Those who wish to invest in a portfolio where the fund manager dynamically changes the duration based on how market conditions shape up may invest in a dynamic bond fund.

“Here the professional fund manager decides where the opportunities lie across different parts of the yield curve,” says Vishal Dhawan, founder and chief executive officer, Plan Ahead Wealth Advisors.

By managing duration actively, he tries to generate alpha.

Calls can go wrong

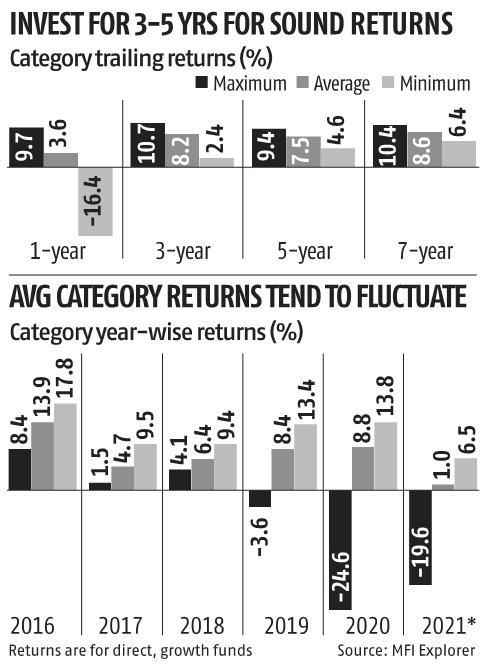

Those who invest in this category need to be aware that the fund manager’s interest-rate calls can go wrong, thereby affecting returns.

This can cause year-to-year returns to fluctuate.

Aggressive credit calls have also gone wrong in the past, resulting in papers being placed in segregated portfolios.

Before you invest, check the fund manager’s track record in managing such a strategy.

Banthia suggests checking the risk-adjusted return over at least a three-year timeframe.

Check the credit quality of the portfolio also.

If the fund manager has to move easily from one duration bucket to another, the papers he holds should be liquid in nature.

The portfolio should also not carry concentration risk (too large a portion of the fund should not be invested in a single paper).

Don’t invest for the short term

In the current environment, the bulk of an investor’s portfolio should be in funds that have an average duration of one year or less.

To augment returns, a small portion may be put in a dynamic bond fund.

“Conservative investors may hold dynamic bond funds to the extent of 10 per cent of their debt fund portfolio while aggressive ones may hold up to 20 per cent,” says Dhawan.

Finally, do not invest in them for the short term. “Instead of investing in a long-maturity fund, you can be a little defensive and invest in a dynamic bond fund with a horizon of three-five years,” says Sen.

- MONEY TIPS

Feature Presentation: Aslam Hunani/Rediff.com

Source: Read Full Article