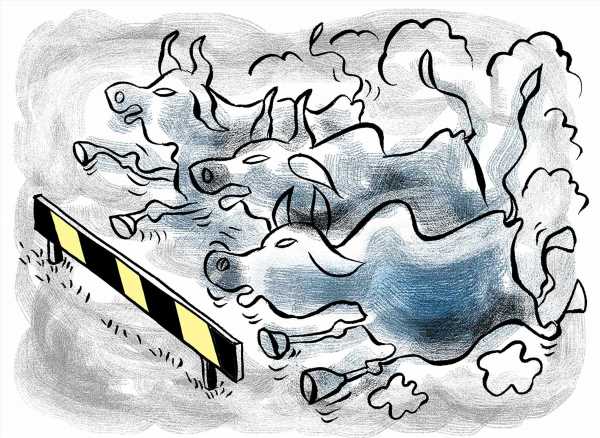

Even if the bull run may continue, most experts say some profit booking is called for, points out Sanjay Kumar Singh.

With the major indices like the Sensex and the Nifty 50 trading above the 60,000 and the 18,000 level respectively, investors are asking two questions: Should they book profits? And if they do, where should they put the money?

Should you book profits?

Many investors wish to book profits because they feel that a correction is imminent in the equity markets after such a strong run up.

Experts say that may not necessarily happen.

“There is too much liquidity in the system for a steep correction to happen,” says Ankur Kapur, managing partner, Plutus Capital, a Sebi-registered investment advisory firm.

And while the start of tapering by the US Federal Reserve from November onwards may cause some foreign institutional investor (FII) money to exit, money from domestic financial institutions and retail investors may prevent a steep fall.

Moreover, the domestic economy is recovering.

“This rally has more legs because the growth outlook is improving,” says Rajesh Cheruvu, chief investment officer, Validus Wealth.

Even if the bull run may continue, most experts are of the view that some profit booking is called for.

“You would have become overweight on equities due to the run up in the markets, so do partial profit booking,” says Kapur.

What should mutual fund investors do?

The profit booking should be in line with your original asset allocation and sub-asset allocation.

“Reallocate money from equities towards debt and gold. Similarly, if allocation to mid- and small-caps has become heavier than the original level, reduce it,” says Kapur.

Investors who desire safety should move towards shorter-duration debt funds.

Match your investment horizon with the average portfolio duration to zero in on the exact category.

As interest rates move up, the yield to maturity of these funds will improve.

Investors with a longer horizon may opt for target maturity funds.

If your goal is just a year or so away, opt for an arbitrage fund.

While their returns may be similar to those from a short-duration fund, these funds will get the tax treatment of equities and will hence give better post-tax returns.

“If you have a a two-three-year horizon, you may go for a conservative hybrid fund. These funds have an allocation of 10-25 per cent in equities,” says Kapur.

He suggests choosing a fund that invests the bulk of its equity portfolio in high dividend yield stocks.

He expects such funds to be able to deliver a 7-7.5 per cent return.

Investors whose goals are a year or so away must pull money out of equities immediately and put it in a safe fixed-income instrument.

Investors may also use the current market upsurge to improve the quality of their mutual fund portfolios.

“Many non-performing funds have also moved up. Sell them and move to better quality funds,” says Cheruvu.

He also suggests moving out of funds that have very large assets under management (AUM).

“Such funds have found it difficult to reorient their portfolios according to changing market conditions. Exit them and move to more reasonable sized funds,” adds Cheruvu.

Retail investors should avoid the mistake of entering thematic and sectoral funds at this point.

Past returns of many of these funds may be looking good at present.

But they have the potential to hurt your portfolio badly.

What should direct equity investors do?

Direct equity investors who don’t do research on their own should exit immediately.

“These investors have made gains due to luck rather than skill. They should book gains immediately and quit,” says Kapur.

In many stocks, he says, market valuations have reached irrational levels.

Even if a market-wide correction does not happen, such stocks are likely to correct.

“When the inevitable correction comes, these investors will not know why that is happening and will find it difficult to hold on to them,” says Kapur.

Direct investors who desire safety should move into large-cap, blue chip stocks.

“These stocks are expensive, so they won’t give high returns in the near term. But your money will be safe in them,” says Kapur.

Knowledgeable direct equity investors who do their own research may reorient their portfolios towards growth stocks.

“While quality stocks have performed in the past, growth-oriented stocks are likely to do better in the future,” says Cheruvu.

He adds that while highly leveraged stocks should be avoided, it is okay to invest in stocks with debt:equity ratio of up to 1:1.

Feature Presentation: Aslam Hunani/Rediff.com

Source: Read Full Article