‘Sector funds like IT funds should be included only in the satellite portfolio.’

‘Limit your exposure to IT sector funds to around 5-10 per cent of your equity portfolio.’

With Indian information technology stocks tumbling in line with their global counterparts, IT sector funds have also taken a beating.

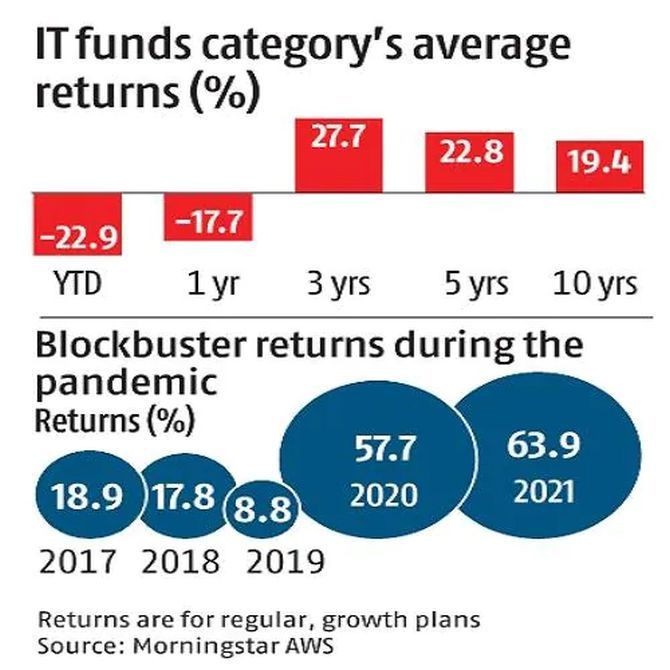

They have declined 22.9 per cent on an average == year-to-date — and are currently the worst-performing fund category of 2022.

However, experts say the current downturn offers an opportunity for contrarian buying in these funds.

Mirroring global trend

IT sector funds gave blockbuster returns during the pandemic: 57.7 per cent category average in 2020 and 63.9 per cent in 2021.

This was owing to the rapid adoption of digital technologies during that period.

As the demand for tech products rose, so did investor expectations.

Valuations of these stocks rose to very high levels, especially in the United States.

However, as global central banks began raising interest rates, tech companies worldwide felt the heat.

Indian IT companies too were affected. “When global tech companies’ stocks correct, a spillover effect is visible in the domestic listed universe,” says Chintan Haria, head-product & strategy, ICICI Prudential Mutual Fund.

A weaker rupee is expected to support the earnings of IT companies.

However, rising wages and high attrition rates are affecting them adversely.

“High levels of inflation globally and the fear of recession in the US and Europe are the major causes for the downturn in the IT sector,” says Anup Bansal, chief business officer, Scripbox.

What lies ahead?

The sharp correction has pulled down valuations. The price-to-earnings multiple of the Nifty IT Index has declined from 38.9 (December 31, 2021) to 25.7 (November 9, 2022).

“Valuations remain expensive. The possibility of further correction can’t be ruled out,” says Pankaj Mathpal, managing director, Optima Money Managers.

The long-term growth story of Indian IT, however, remains intact. Digitalisation and increasing reliance on technology are irreversible trends.

Companies will continue to invest more on their IT infrastructure, even though there may be temporary cuts.

Significant growth may come from cloud-based services where Indian IT companies are working with global giants.

“From a medium to long term perspective, global and domestic technology companies have indicated that the structural demand for digital transformation remains intact, notwithstanding the near-term volatility. Early signs of this are visible through the trend around increase in contract duration, especially in connection with cloud technology,” says Haria.

The long-term returns from IT sector funds (19.4 per cent category average return over 10 years) has been very encouraging, adds Haria.

Mathpal also suggests accumulating units of these funds in a staggered manner. “Use every correction as an opportunity to buy,” he says.

Taking the MF route

Around 15 IT sector funds currently manage assets worth Rs 23,387 crore (Rs 233.87 billion).

The majority are passive funds, like the recently launched HDFC Nifty IT Exchange Traded Fund, which tracks the Nifty IT Index.

If you think that the sector will do well and are happy with index-equivalent return, you may invest in them.

Five active funds are available where the fund managers decide which stocks to buy.

Some of them also allocate money to overseas tech stocks.

Since the IT sector is fairly complex with many companies that specialise in a variety of sub-segments and have different revenue models, professional fund managers can help you handle the complexity.

Beware of concentration risk

Sector funds like IT funds are riskier than diversified-equity funds.

“Sector funds have the potential to provide higher returns than diversified-equity funds and hybrid funds, but they can also be more volatile and vulnerable to losses,” says Bansal.

The diversified-equity funds in your portfolio already have exposure to the IT sector. Invest in IT sector funds only if you want exposure over and above this.

“Fill your core portfolio with diversified-equity funds. Sector funds like IT funds should be included only in the satellite portfolio. Limit your exposure to IT sector funds to around 5-10 per cent of your equity portfolio,” says Mathpal. Invest with a 7-10-year horizon.

- MONEY TIPS

Feature Presentation: Aslam Hunani/Rediff.com

Source: Read Full Article