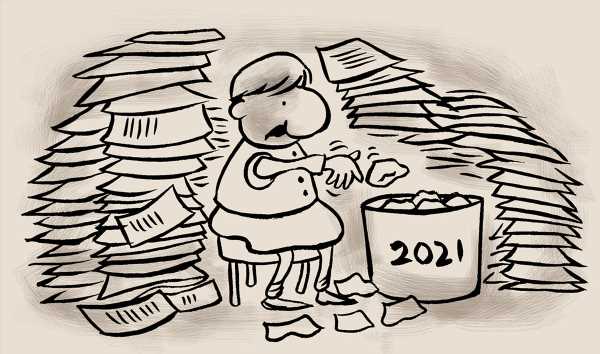

The trick is to know how long you are supposed to hold which document, observes Bindisha Sarang.

Storing financial documents was simple until a decade ago.

You either rented a bank locker or stored them in a home safe.

Today it’s much more complicated.

Mrin Agarwal, financial educator, and director, Finsafe India says, “Today individuals have several financial relationships; bank accounts, mutual funds, stocks, other investment, loans, the list goes on.”

One may argue that many of these documents reach us in digital format.

But with information coming from so many sources are keeping our inboxes full and unmanageable.

Prateek Mehta, co-founder and chief business officer, Scripbox, says, “Customers today get inundated with a lot of communication. This overwhelms them, making them move to a default mode of giving up (and not dealing with so many financial mails/statements) and opting to use either the search bar in the mail or contact the financial institution to obtain the said document.”

Apart from document overload, you have to deal with Know Your Customer (KYC) norms too, and sometimes you spouse’s paperwork as well.

And, not knowing which ones are too old and need to be discarded, you invariably end up storing all and increasing the financial clutter.

How long:

The trick is to know how long you are supposed to hold which document.

Tax:

Is how long too long when it comes to keeping Income Tax Return (ITR) documents? Gopal Bohra, partner, NA Shah Associates, says, “A taxpayer should preserve all his tax statements and other working papers for at least seven years, from the end of the relevant financial year.

This is because the Income-tax Act permits the tax department to re-open the assessment of a particular year till the end of this period.

” In case an old matter is under litigation, it is advisable to preserve the relevant documents till the time such litigation is ultimately settled.

Bohra says, “If, during a search conducted on a taxpayer’s premises, the assessing officer finds that there is an asset or income exceeding Rs 50 lakh that hasn’t been disclosed, he can scrutinise up to 10-year-old records.”

Further, in case one is earning income from a foreign source or has a foreign asset, it is advisable to preserve documents on such income source or asset for a period of 17 years from the end of relevant financial year, which is the permissible limit for tax authorities to re-open the assessment in case they have reason to believe of the income has been concealed.

Banking:

The documents we are most unsure of are papers pertaining to loans that have been paid off.

Adhil Shetty, chief executive officer, Bankbazaar, says, “Broadly, you should retain your loan documents for at least eight years after the loan is closed. This is long enough for any disputes to emerge.”

Also, as per RBI norms, banks are required to retain records for 5-8 years. So, you should retain these for said period as well.

Shetty adds, “If you have taken any home improvement or personal loan to upgrade your property, you’ll need to retain those records until you sell off your property if you wish to claim capital gains against it.”

It is equally important to know what documents to retain.

Typically, you will receive a no-dues certificate from the bank stating that the loan has been closed.

Shetty says, “In the case of a home loan, you will also need to get the lien on the property removed. Once this is done, the loan would be closed and the changed status should reflect in your credit report.”

Insurance:

It is good to store your all insurance-related documents.

You never know when you may have to show them even after the reimbursement.

Naval Goel, CEO, PolicyX.com says, “If the customer is looking for tax benefits or rebates then he should keep the receipts ready and can attach them to the ITR at the time of filing.”

When it comes to general insurance, the obvious question is how long should you keep hospital payment papers, after getting reimbursed by health insurance.

Or car service papers after getting the amount in case of car insurance.

The longer the customer can keep the hospital payment records, the more beneficial.

Also keep your hospital payment and car repair payment papers for a long tenure even after getting the reimbursement.

Goel says, “It will help you at the time of portability as well. There might be several stages when you will have to show them to the insurer for verification purpose.”

The same applies for car insurance.

You can use the e-insurance account, as you can have access to all your insurance documents easily.

Goel says, “These days almost all insurance companies are offering the e-insurance account facility where you can store your insurance documents and those of your family as well.”

Mutual funds:

Mehta says, “National Securities Depository Limited (NSDL) Consolidated Account Statement (CAS), enumerates all your MF holdings, stock holdings, bonds, etc. You can set an auto forward to a common IDd you share with a family member, to obtain one consolidated view.”

NSDL CAS is a single statement of all your investments in the securities market.

For mutual funds, you can use the Computer Age Management Services (CAMS) portal.

Mrin Agarwal says, “It’s a good practice to get your CAMS statement at the end of the year to get a consolidated view of your investments.”

Keep your year-end stock and mutual fund account statements in your tax files for three years.

If you are self-employed, you need to keep these annual statements for six years.

Other documents:

Documents related to purchase, sale, transfer expenses and any improvements made on your property need to be preserved till the expiry of seven years from the year in which such asset is sold because the tax department can reopen the assessment at any time during this period as per the law.

Bohra says, “Taxpayers should store historical documents (such as invoice for purchase of jewellery, paintings, and improvement to premises) of assets owned by them so that when sold, the tax department cannot deny deduction for want of documentary evidence.”

Also, take an inventory of all your investments.

Mehta says, “It’s quiet possible you bought a policy for 20 years and forgot about it after 5-6 years. It’s important to keep an inventory of all your investments.”

Digital security:

Manoj Chopra, vice president and head-product & innovation, Infrasoft Tech says, “There are two ways to save the documents. Locally, on your desktop, laptop, or pen drive or on a secure cloud service.”

When it comes to digital storage most either let these stay in their personal, general or dedicated e-mails for financial matters.

Chopra adds, “Saving in e-mail is unsafe, you should always download and password-protect it. You can also use Bitlocker for better protection.”

BitLocker is a built-in encryption feature included with Microsoft Windows versions starting with Windows Vista for protecting data with encryption.

Another popular option is storing your documents on clouds like Google documents, iCloud and Dropbox.

You can register on these sites and upload scanned documentsm and access them from anywhere in seconds, even with your smartphone.

Chopra says, “Always have double protection by storing things locally and as back-ups on two cloud service providers. In fact, The Government of India’s flagship programme, DigiLocker, is an excellent tool too.”

All these tips will definitely help you become more methodical and organised while dealing with paperwork and digital statements.

But at the same time, ensure that at least one person knows where you have kept documents along with passwords, especially if they are stored in a cloud somewhere.

And remember to shred any document with personal information on it before you toss it in the dustbin.

- MONEY TIPS

Feature Presentation: Aslam Hunani/Rediff.com

Source: Read Full Article