‘Advertising this season will help IPL surpass $550 million in ad revenues, across digital and pay TV.’

‘It should still represent a steep loss against annualised 2023-2027 IPL rights fees of $1.2 billion.’

The match between Chennai Super Kings and Gujarat Titans delivered what an Indian Premier League final should — thrill, excitement, reach and (hopefully) revenues.

Not surprisingly, fans and cricket buffs are comparing it to the likes of the American NFL’s Super Bowl and the FIFA World Cup.

So how big is the IPL?

It is over four times the size of the Super Bowl in viewership, but one-third of the FIFA World Cup.

The IPL makes it comfortably to a rough list of the top 10 global sports events by audiences — across streaming and television.

The numbers for the entire tournament are yet to come in. But here are the initial reports.

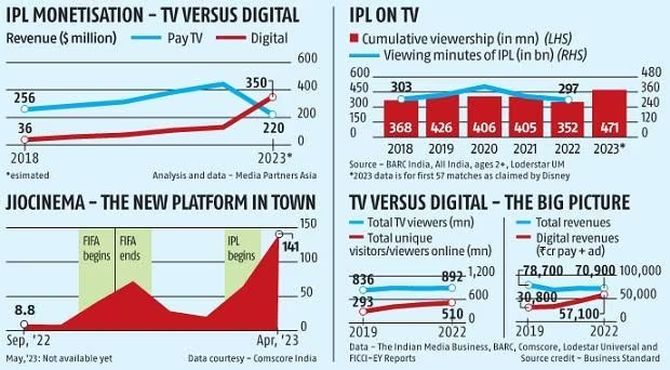

More than 471 million people tuned in to watch the first 57 matches on the Disney Star Network, going by Broadcast Audience Research Council data shared by Disney.

Reliance Industries-owned Viacom18’s JioCinema, which has the streaming rights, reached 141 million in April, the first full month of the tournament, going by Comscore data.

Though there is some overlap between TV and streaming, you could say that Tata IPL 2023 reached over 600 million people. That is a good number.

Over the years, the IPL has averaged about 500 million viewers across TV and digital.

It is, however, the Tour de France, a cycling event spread over 23 days and 2,200 miles, that is the most-watched sports event in the world with 3.2 billion viewers, according to a BBC report.

The soccer World Cup is close to over 3 billion.

The ICC Cricket World Cup is the third largest at 2.06 billion viewers across the world.

Then comes boxing, the Olympics and other sports. The IPL is probably at number seven or eight. There is, however, no comprehensive and credible list of the most-viewed sporting events.

Much of this data is gleaned from the Web sites of individual sports leagues or media reports.

The cost of IPL rights, however, keeps going up.

Both JioCinema and Disney India paid close to Rs 24,000 crore (Rs 240 billion) each for streaming and broadcast rights, respectively, earlier this year.

That is a total of Rs 48,000 crore (Rs 480 billion) against the Rs 16,347 crore (Rs 163.47 billion) that Disney paid for both television and streaming rights for IPL 2017-2022.

Not surprisingly, IPL dominates sports in India, bringing in roughly a third of the Rs 14,209 crore (Rs 142.09 billion) spent on sports by advertisers in 2022.

Going by Media Partners Asia analysis, IPL 2017-2022 made an operating profit of $281 million (over Rs 2,300 crore/Rs 23 billion at current dollar rates) at the end of its five-year term.

That brings it to the next question — can JioCinema and Disney make money on the IPL?

MPA estimates that IPL 2023 will get $550 million (Rs 4,510 crore/Rs 45.10 billion) in advertising revenue, across both streaming and TV.

It reckons that JioCinema will get about Rs 2,700 crore/Rs 27 billion or 60 per cent of that.

It says Disney will get about $220 million (Rs 1,800 crore/Rs 18 billion), about half the ad revenue it made on TV in IPL 2022.

The IPL 2023 Test, a report by MPA released in March this year, reckons that this IPL comes amid some macro challenges

“Despite the funding winter hitting the start-up ecosystem, the return of legacy companies’ (Jio, Airtel, cola majors) advertising this season will help IPL surpass $550 million in ad revenues, across digital and pay TV. It should still represent a steep loss against annualised 2023-2027 IPL rights fees of $1.2 billion,” says Mihir Shah, vice-president, MPA.

Source: Read Full Article