vVijay Mallya on Wednesday lost an appeal to gain further access to court-held funds to cover his costs for legal proceedings in India, as a high court judge in London concluded that the 65-year-old businessman had failed to provide sufficient evidence in support of the over 750,000 pounds being sought.

During a remote hearing of the Chancery Division, Justice Robert Miles handed down his judgment in favour of a consortium of Indian banks led by the State Bank of India (SBI).

He also directed Mallya to cover 95 per cent of the costs of the appeal as the banks had been “very substantially successful” and the “overall winners” in fighting the case to prevent further sanctions from the court-held funds.

“The amount being sought was substantial, being over 550,000 pounds in respect of incurred costs and well over 200,000 pounds in respect of the future,” said Justice Miles.

“There was no breakdown of the incurred costs between the various sets of proceedings, there was no attempt to justify the incurred costs by reference to steps already taken; no invoices, bills of costs, descriptive schedules or other evidence was provided in support of the amount of costs being sought,” he said, adding that the proceedings in India appear to be “stagnant”.

The latest appeal follows Deputy Insolvency and Companies Court Judge Nigel Barnett’s February order that gave Mallya permission to use around 1.1 million pounds from the Court Funds Office (CFO) towards his living expenses and to meet legal expenses only related to the ongoing bankruptcy proceedings in the UK – the next hearing for which is scheduled for July 26.

The expenditure incurred from the CFO could face further scrutiny at a later date on the conclusion of that petition, lodged by the banks in pursuit of a judgment debt which stands at over 1 billion pounds.

Wednesday’s ruling followed an appeal hearing on Tuesday during which the businessman’s lawyers made representations to meet the costs of three-pronged proceedings in the Indian courts, related to unpaid loans to the now-defunct Kingfisher Airlines.

Mallya’s barrister, Philip Marshall, repeated previous assertions that the COVID-19 pandemic had caused “very, very substantial disruption to the Indian legal system” and that the lawyers in India had effectively downed tools until their costs were cleared.

“The lawyers do need to be paid and therefore these are necessary expenses towards proceedings with a very reasonable prospect of success,” said Marshall.

Tony Beswetherick, the barrister appearing on behalf of the Indian banks, had countered that any such sanction of funds would be “contrary to the interest of the creditors”.

Mallya remains on bail in Britain, having lost a separate legal battle against extradition to India to face charges of fraud and money laundering.

The high court was informed earlier that the businessman has applied for “another route” to stay in the UK, which is believed to refer to a confidential asylum application.

Meanwhile, Mallya has been fighting against being declared bankrupt in the high court and has repeatedly sought access to funds to meet his mounting legal costs, both in the UK and India.

The SBI-led consortium of 13 Indian banks, which also includes Bank of Baroda, Corporation bank, Federal Bank Ltd, IDBI Bank, Indian Overseas Bank, Jammu & Kashmir Bank, Punjab & Sind Bank, Punjab National Bank, State Bank of Mysore, UCO Bank, United Bank of India and JM Financial Asset Reconstruction Co. Pvt Ltd, had initiated the proceedings against Mallya in December 2018.

There have been a series of hearings in the case and related cost matters since then.

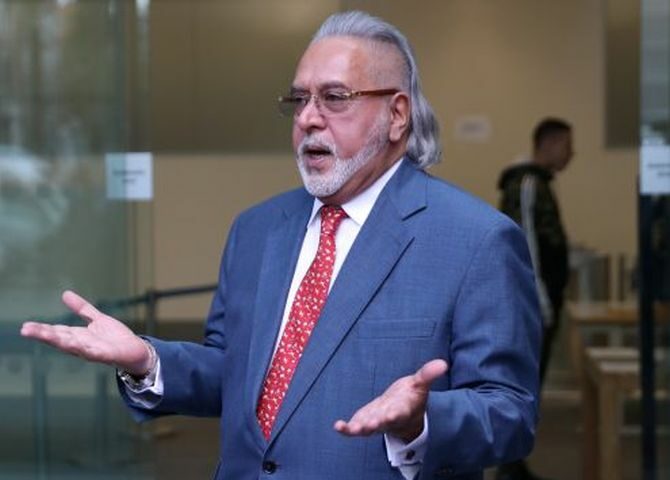

Photograph: Simon Dawson/Reuters

Source: Read Full Article