Tech stocks spur gains; ‘cooling inflation, pickup in manufacturing aid sentiment’

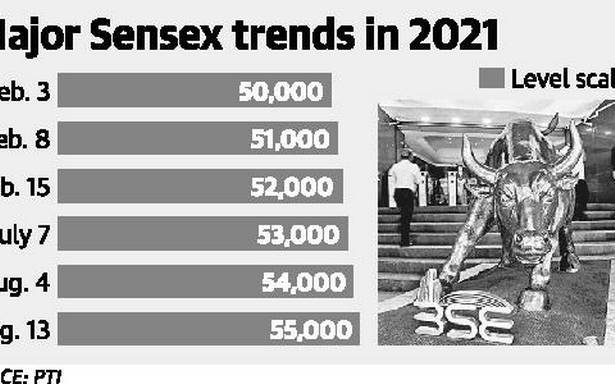

Benchmark equity indices closed at record highs on Friday, with the S&P BSE Sensex scaling the 55,000 mark, propelled by consumer and technology stocks.

Amid sustained buying in blue-chip stocks, the Sensex rose 593.31 points, or 1.08%, to 55,437.29 points. The NSE Nifty 50 climbed 164.70 points, or 1.01%, to 16,529.10, its highest close ever.

The top Nifty-50 gainers included Tata Consumer, which rose 4%, TCS (3.11%), L&T (2.56%), HCL Tech (2.5%) and Tata Steel (2.22%). Reports of a dip in retail inflation in July and pickup in manufacturing activity in June buoyed market momentum, analysts said.

“Factors like strong corporate results, inflation cooling off and a few sectors finding favour have all resulted in the Sensex touching new all-time highs,” said Rahul Shah, co-head of Research, Equitymaster. “Above all, it is the optimism and euphoria, especially from retail investors that’s keeping the party going,” he added.

He said the fear of losing in a falling market witnessed in March 2020 “has now been replaced by euphoria and greed.” He said if it had been time to be aggressive in buying stocks back in March 2020, it is perhaps time now to turn a ‘tad defensive’. “This does not mean there’s a crash coming or one should just get out of stocks entirely… But it may not be a bad idea to tweak one’s allocation a little and liquidate maybe a small portion of the portfolio,” Mr. Shah said.

According to a BSE presentation, it took 129 trading sessions for the Sensex to go from 50,000 to the 55,000-mark. The Sensex had crossed the 50,000 closing level on February 3. The journey from 45,000 to 50,000 was covered in 41 trading sessions while the 40,000 to 45,000 milestone took 375 trading sessions.

Source: Read Full Article