IndusInd Bank was the top gainer in the Sensex pack, advancing around 3 per cent, followed by Kotak Bank, SBI, HDFC Bank, ICICI Bank and Bajaj Finance.

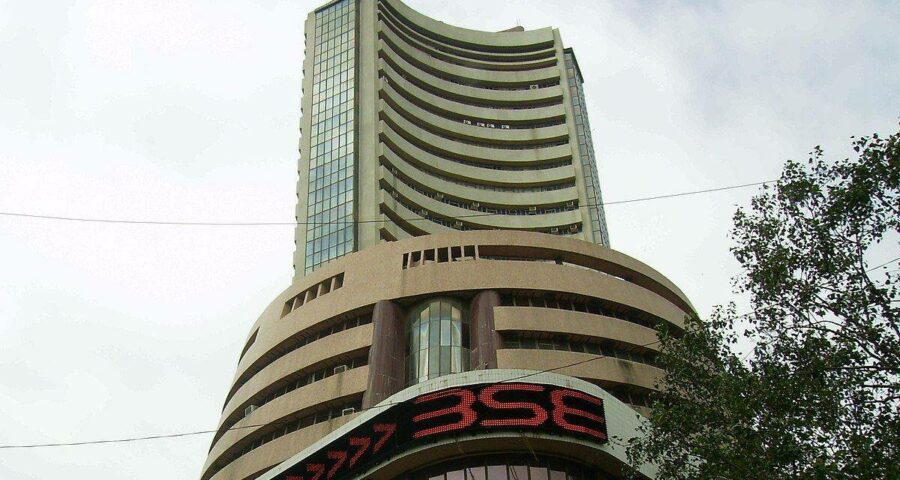

Equity benchmark Sensex rallied over 400 points in opening trade on Friday, tracking gains in index majors HDFC twins, ICICI Bank and Kotak Bank, despite a negative trend in global markets.

The 30-share BSE index was trading 408.56 points or 0.82 per cent higher at 49,973.42, and the broader NSE Nifty surged 119.35 points or 0.80 per cent to 15,025.40.

IndusInd Bank was the top gainer in the Sensex pack, advancing around 3 per cent, followed by Kotak Bank, SBI, HDFC Bank, ICICI Bank and Bajaj Finance. On the other hand, PowerGrid was the sole loser.

In the previous session, Sensex finished at 49,564.86, down 337.78 points or 0.68 per cent, and Nifty closed 124.10 points or 0.83 per cent lower at 14,906.05.

Foreign institutional investors (FIIs) were net buyers in the capital market as they purchased shares worth Rs 71.04 crore on Thursday, as per provisional exchange data.

Domestic equities look to be good as of now, said Binod Modi, Head-Strategy at Reliance Securities, adding that benchmark indices witnessed sharp run-up this week despite selling pressure seen in the last two days as daily caseload in the second wave of COVID-19 continued to be below 3 lakh, which offered comfort and may result in lifting of ongoing state-level lockdowns sooner.

Further, assumption of second wave of COVID-19 to peak-out by the end of May or mid of June holds true and the adverse impact of the second wave should not be felt beyond 1QFY22, he noted.

In the US, stocks ended higher mainly on upbeat economic data, Modi said, adding that jobless benefit claims for last week fell to a pandemic low at 4.44 lakh.

Elsewhere in Asia, bourses in Shanghai, Hong Kong and Seoul were trading on a negative note in mid-session deals, while Nikkei was trading in the positive terrain.

Meanwhile, international oil benchmark Brent crude was trading 0.09 per cent higher at USD 65.16 per barrel.

Source: Read Full Article