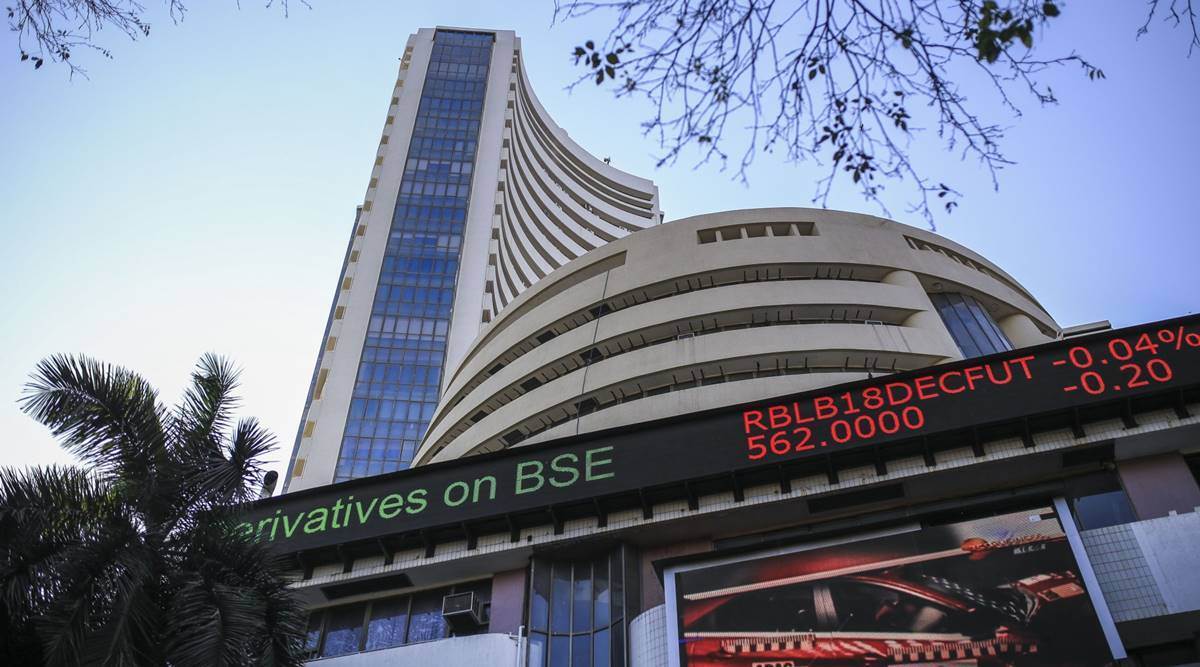

Share Market Today: The Sensex surged 334.61 points (0.67 per cent) to hit a record high of 50,126.73, while the broader Nifty 50 too climbed 93.60 points (0.64 per cent) to touch a new lifetime high of 14,738.30.

The S&P BSE Sensex breached the 50,000-mark for the first time during the early trade on Thursday aided by market heavyweight Reliance Industries (RIL) and the Bajaj twins comprising of Bajaj Finserv and Bajaj Finance amid positive cues from the global market.

The Sensex surged 334.61 points (0.67 per cent) to hit a record high of 50,126.73, while the broader Nifty 50 too climbed 93.60 points (0.64 per cent) to touch a new lifetime high of 14,738.30.

RIL, Bajaj Finance, ICICI Bank and Axis Bank were leading contributors to the rise in Sensex during the early trade on Thursday.

On Wednesday, the Sensex had rallied 393.8 points, or 0.8 per cent, to close at 49,792.12. The Nifty 50 rallied by 123.85 points, or 0.85 per cent, to close at 14,644.7.

Among the sectoral indices on the National Stock Exchange (NSE), the Nifty Auto index was trading over 1 per cent higher on early trade Thursday driven by gains in the shares of Tata Motors, Eicher Motors and Bajaj Auto. The key Bank Nifty too was up around 0.5 per cent led by RBL Bank, IndusInd Bank and Bandhan Bank.

“The liquidity expansion by the central bank and the ample FII driven liquidity, a V shaped recovery of growth aided by the discovery of vaccine, and most recently the change of guard in US have been some of the factors propelling markets higher and higher. As the sensex crosses the 50k, the valuations do look stretched. The valuations are a function of earnings and earnings not coming through remains the key risk at the current juncture,” said Joseph Thomas, Head Of Research at Emkay Wealth Management.

In the broader market, the S&P BSE MidCap index was up over 0.5 per cent at 19,268.97, while the S&P BSE SmallCap was trading at 18,837.02, up 0.50 per cent at around 10:00 am.

Global market

Asian stocks rose to new record highs on Thursday, tracking US markets as investors hoped for more economic stimulus from newly inaugurated US President Joe Biden to offset damage wreaked by the COVID-19 pandemic.

Republicans in the US Congress have indicated they are willing to work with the new president on his administration’s top priority, a $1.9 trillion US fiscal stimulus plan, but some are opposed to the plan’s price tag.

MSCI’s broadest index of Asia-Pacific shares outside Japan touched record highs and was last up 0.85 per cent, with markets across the region posting gains.

Chinese blue-chips added 1.2 per cent, Australian shares climbed 0.69 per cent and Hong Kong’s Hang Seng breached the 30,000 level, rising 0.31 per cent.

Japan’s Nikkei was up 0.72 per cent, less than 1 per cent off three-decade highs reached last week.

The rises in Asia followed fresh record highs on Wall Street overnight. The Dow Jones Industrial Average rose 0.83 per cent, the S&P 500 gained 1.39 per cent and the Nasdaq Composite added 1.97 per cent. On Thursday, e-mini futures for the S&P 500 ticked up to new records and were last up 0.26 per cent.

–global market input from Reuters

Source: Read Full Article