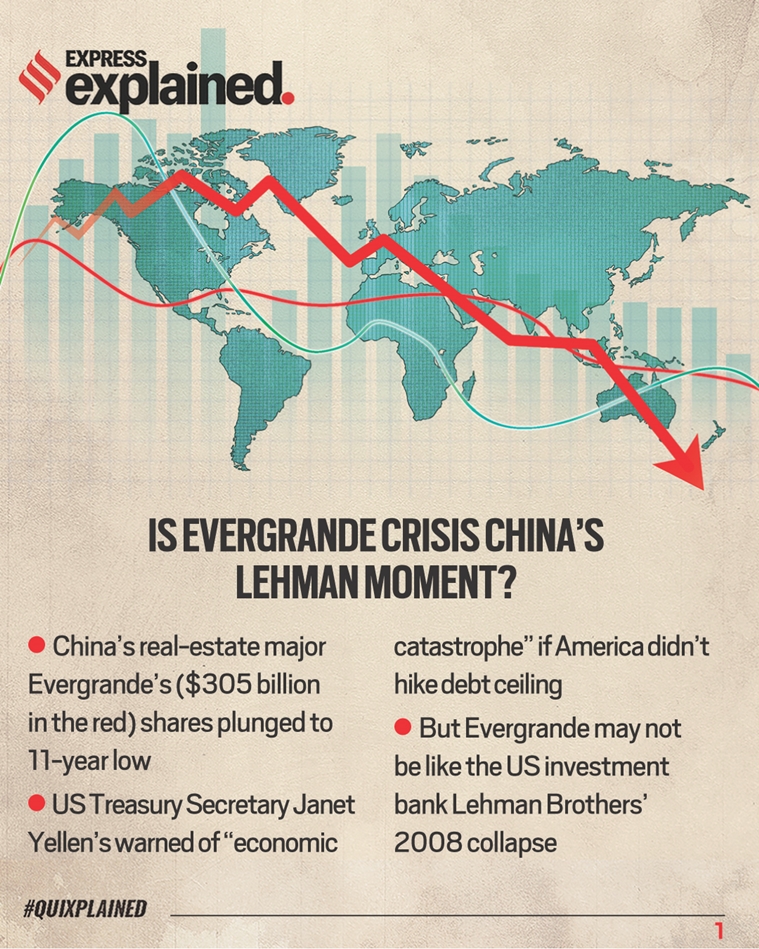

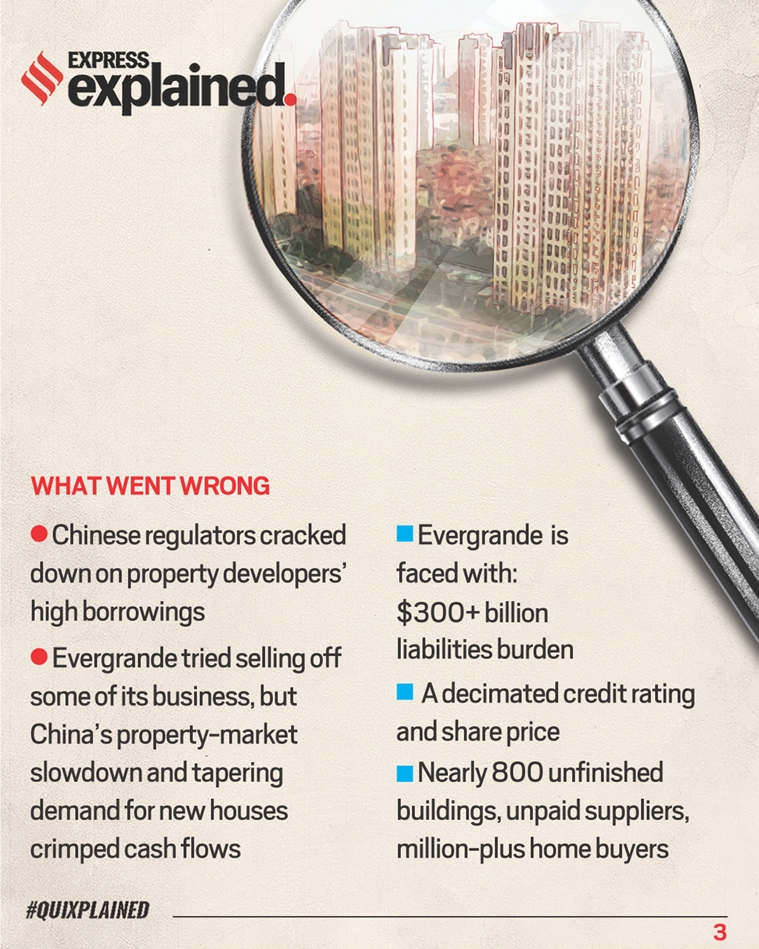

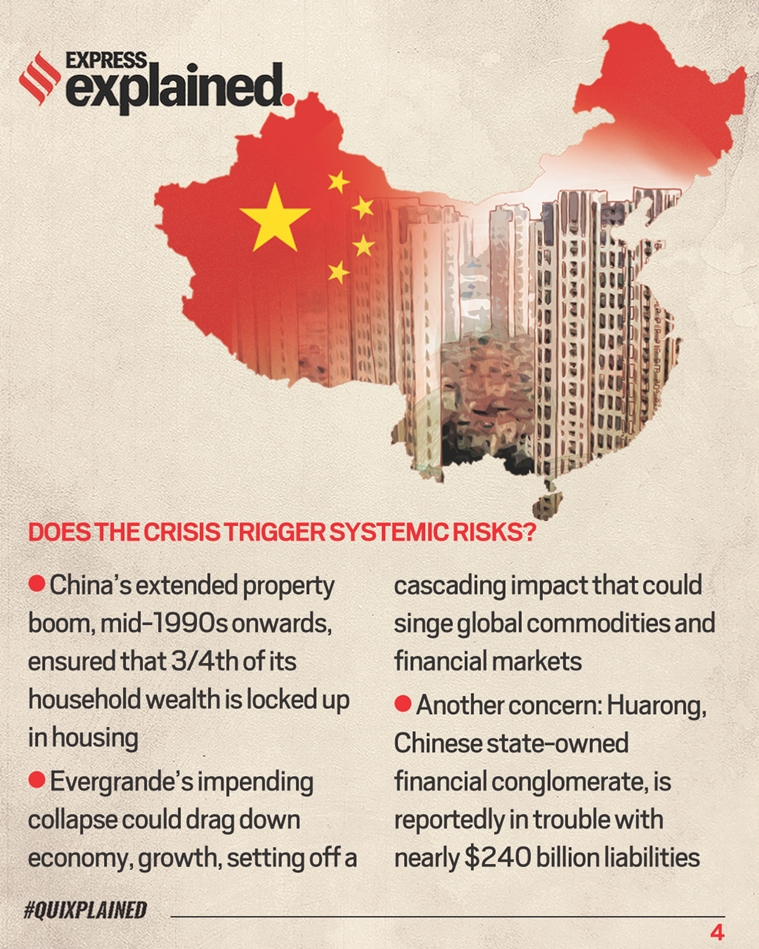

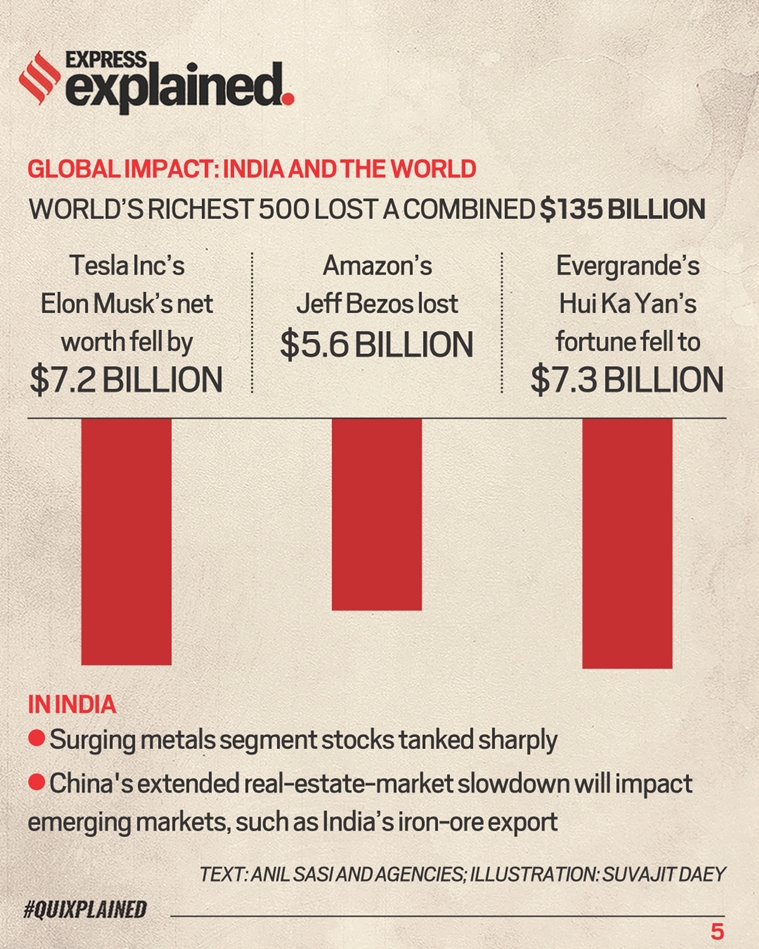

Evergrande has been scrambling to raise funds to pay its many lenders, suppliers and investors, with regulators warning that its $305 billion of liabilities could spark broader risks to the country’s financial system if not stabilised.

China Evergrande Group shares plunged on Monday to over 11-year lows, extending losses as executives try to salvage its business prospects and as default fears grow over a looming deadline for payment obligations this week.

Evergrande has been scrambling to raise funds to pay its many lenders, suppliers and investors, with regulators warning that its $305 billion of liabilities could spark broader risks to the country’s financial system if not stabilised.

The stock closed down 10.2% at HK$2.28, after earlier plummeting 19% to its weakest level since May 2010.

Evergrande, a company that started out in 1996 selling bottled water followed by a stint in pig farming, now owns China’s top professional soccer team (Guangzhou Football Club, managed by former Real Madrid centre back Fabio Cannavaro), and has long been the poster boy of the Chinese real estate boom. It rode on a sustained property prices surge in China — the main driver of the post-pandemic Chinese economic expansion — to expand into more than 250 Chinese cities selling home-ownership dreams to the country’s middle class.

Source: Read Full Article