The government has set up two new entities to acquire stressed assets from banks and then sell them in the market. Why was the need felt, how will the two entities work, and to what extent does it help?

Following through with one of her key announcements in the Budget, Finance Minister Nirmala Sitharaman has announced the formation of India’s first-ever “Bad Bank”. She said the “National Asset Reconstruction Company Limited” (NARCL) has already been incorporated under the Companies Act. It will acquire stressed assets worth about Rs 2 lakh crore from various commercial banks in different phases. Another entity — India Debt Resolution Company Ltd (IDRCL), which has also been set up — will then try to sell the stressed assets in the market. The NARCL-IDRCL structure is the new bad bank. To make it work, the government has okayed the use of Rs 30,600 crore to be used as a guarantee.

What is a bad bank? Why was it needed?

In every country, commercial banks accept deposits and extend loans. The deposits are a bank’s “liability” because that is the money it has taken from a common man, and it will have to return that money when the depositor asks for it. Moreover, in the interim, it has to pay the depositor an interest rate on those deposits.

In contrast, the loans that banks give out are their “assets” because this is where the banks earn interest and this is money that the borrower has to return to the bank.

The whole business model is premised on the idea that a bank will earn more money from extending loans to borrowers than what it would have to pay back to the depositors.

Imagine, then, a scenario where a bank finds a huge loan not being repaid because, say, the firm that took the loan has failed in its business and is not a position to pay back either the interest or the principal amount.

Every bank can take a few such knocks. But what if such “bad loans” (or the loans that will not be paid back) rise alarmingly? In such a case, the bank could sink.

Now imagine a scenario where several banks in an economy face high levels of bad loans and all at the same time. That will threaten the stability of the whole economy.

In normal functioning, as the proportion of bad loans — they are typically calculated as a percentage of the total advances (loans) — rise, two things happen. One, the concerned bank becomes less profitable because it has to use some of its profits from other loans to make up for the loss on the bad loans. Two, it becomes more risk-averse. In other words, its officials hesitate from extending loans to business ventures that may remotely appear risky for the fear of aggravating an already high level of non-performing assets (or NPAs).

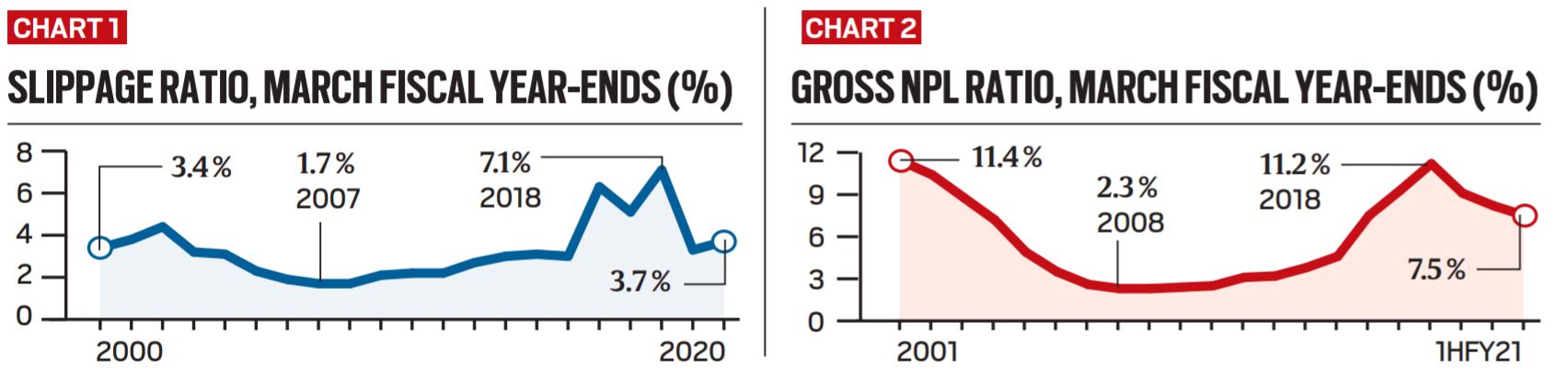

In India, as can be seen from Charts 1 and 2, the level of NPAs rose alarmingly since 2016. In a big way, this was a result of the RBI requiring banks to clearly recognise the bad loans on their books. The fact is several banks had witnessed progressive souring of their loans portfolio since the global financial crisis of 2008-09.

From the taxpayer’s perspective, the most worrisome fact was that an overwhelming proportion of NPAs was with the public sector banks, which were owned by the government and hence by the Indian public. To keep such PSBs in business, the government was forced to recapitalise them — that is, use taxpayers’ money to improve the financial health of PSBs so that they could carry on with the business of lending and funding economic activity.

But with each passing year, NPAs continued to mount — not helped by the fact that the economy itself started to lose its growth momentum since the start of 2017.

It was argued by many that the government needs to create a bad bank — that is, an entity where all the bad loans from all the banks can be parked — thus, relieving the commercial banks of their “stressed assets” and allowing them to focus on resuming normal banking operations, especially lending.

While commercial banks resume lending, the so-called bad bank, or a bank of bad loans, would try to sell these “assets” in the market.

How will the NARCL-IDRCL work?

The NARCL will first purchase bad loans from banks. It will pay 15% of the agreed price in cash and the remaining 85% will be in the form of “Security Receipts”. When the assets are sold , with the help of IDRCL, , the commercial banks will be paid back the rest.

If the bad bank is unable to sell the bad loan, or has to sell it at a loss, then the government guarantee will be invoked and the difference between what the commercial bank was supposed to get and what the bad bank was able to raise will be paid from the Rs 30,600 crore that has been provided by the government.

Will a bad bank resolve matters?

From the perspective of a commercial bank saddled with high NPA levels, it will help. That’s because such a bank will get rid of all its toxic assets, which were eating up its profits, in one quick move. When the recovery money is paid back, it will further improve the bank’s position. Meanwhile, it can start lending again.

From the perspective of the government and the taxpayer, the situation is a little more muddled. After all, whether it is recapitalising PSBs laden with bad loans or giving guarantees for security receipts, the money is coming from the taxpayers’ pocket. While recapitalisation and such guarantees are often designated as “reforms”, they are band aids at best. The only sustainable solution is to improve the lending operation in PSBs.

Lastly, the plan of bailing out commercial banks will collapse if the bad bank is unable to sell such impaired assets in the market. If that happens, guess who will have to bail out the bad bank itself? Indeed, the taxpayer.

Newsletter | Click to get the day’s best explainers in your inbox

Source: Read Full Article