Updates from the world of economy, markets, and finance

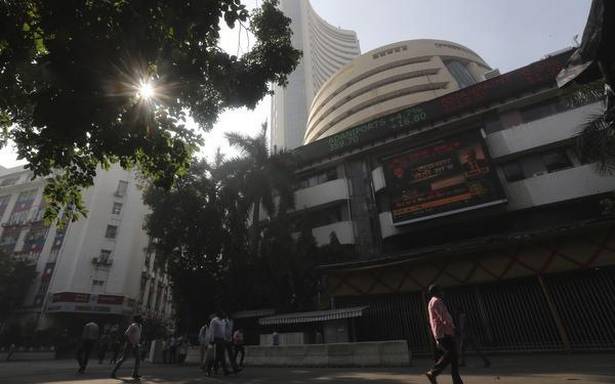

The Nifty and the Sensex opened the day on a negative note, falling further weighed by tanking Reliance shares.

Join us as we follow the top business news through the day.

Doubts over the Chinese economic rebound

Cairn threatens Indian asset seizures abroad in tax case

A month after it won an international tribunal award of $1.2 billion in damages against India in the retrospective taxation case, U.K.-based Cairn Energy Plc has threatened that it may be forced to begin attaching Indian assets including bank accounts in different world capitals, unless the government resolves the issue.

In a letter to the Indian High Commission in London that was also sent to the Prime Minister’s Office, Ministry of External Affairs and the Finance Ministry this week, which The Hindu has seen, Cairn Energy’s top leadership has said that the “necessary preparations have been put in place” in order for the tribunal verdict to be “enforced against Indian assets in numerous jurisdictions around the world” if India fails to discuss paying the amount awarded.

Read more

Rupee rises 8 paise to 72.86 against US dollar in early trade

The rupee diverges from stocks.

PTI reports: "The rupee appreciated 8 paise to 72.86 against the US dollar in opening trade on Wednesday, ahead of the outcome of the US central bank’s meeting.

At the interbank forex market, the domestic unit opened at 72.91 against the US dollar and inched higher to 72.86 against the greenback, registering a rise of 8 paise over its previous close.

On Monday, the rupee had settled at 72.94 against the American currency.

Traders said the local unit was trading in a narrow range against the US dollar on Wednesday morning ahead of the Fed meeting conclusion. Markets are also keenly watching progress on the US stimulus front.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, rose 0.08 per cent to 90.23.

"Asian currencies were mixed against the greenback ahead of the Fed meeting tonight," Reliance Securities said in a research note.

The euro and the sterling have started marginally weaker against the US dollar this Wednesday morning in Asian trade.

On the domestic equity market front, the 30-share BSE benchmark Sensex was trading 294.83 points lower at 48,052.76, and the broader NSE Nifty fell 86.25 points to 14,152.65.

Foreign institutional investors were net sellers in the capital market as they offloaded shares worth Rs 765.30 crore on a net basis on Monday, according to exchange data.

Forex and equity markets were closed on Tuesday on account of Republic Day.

Brent crude futures, the global oil benchmark, rose 0.43 per cent to USD 56.15 per barrel."

GDP to contract 8% in FY21, FICCI survey shows

India’s GDP is expected to contract by 8% in 2020-21, according to the latest round of FICCI’s Economic Outlook Survey.

The annual median growth forecast by the industry body is based on responses from leading economists representing industry, banking and financial services sectors. The survey was conducted in January.

The median growth forecast for agriculture and allied activities has been pegged at 3.5% for 2020-21.

“Agriculture sector has exhibited significant resilience in the face of the pandemic. Higher rabi acreage, good monsoons, higher reservoir levels and strong growth in tractor sales indicate continued buoyancy in the sector,” FICCI stated on the survey findings. However, industry and services sector, which were most severely hit due to the pandemic induced economic fallout, are expected to contract by 10% and 9.2% respectively during 2020-21. The industrial recovery is gaining traction, but the growth is still not broad based. The consumption activity did spur during the festive season as a result of pent-up demand built during the lockdown but sustaining it is important going ahead, the survey said.

Read more

Indian shares slip as Reliance falls after Amazon tries to block Future deal

The fall continues.

Reuters reports: "Indian shares opened lower on Wednesday, weighed down by heavyweight Reliance Industries after U.S. e-commerce giant Amazon.com requested a court to block Future Group’s $3.4 billion retail asset sale to the conglomerate.

The blue-chip NSE Nifty 50 index fell 0.57% to 14,157.30, while the benchmark S&P BSE Sensex slipped 0.56% to 48,059.52 by 0353 GMT.

Shares of Reliance Industries slipped 1.96% and was the top drag on the Nifty.

Future Retail opened 4.9% lower after Amazon.com asked the Delhi High Court to enforce a Singapore arbitrator’s decision and also called for Future Group’s chief executive officer to be detained.

Investors are also eyeing a slew of corporate results due later in the day, including private sector lender Axis Bank and consumer giant Hindustan Unilever."

IMF lifts 2021 global growth forecast

The International Monetary Fund on Tuesday raised its forecast for global economic growth in 2021 and said the coronavirus-triggered downturn in 2020 would be almost a full percentage point less severe than expected.

It said multiple vaccine approvals and the unveiling of vaccinations in some countries in December had boosted hopes of an eventual end to the pandemic.

But it warned that the world economy continued to face ‘exceptional uncertainty’ and global activity would remain well below pre-COVID projections made one year ago. Close to 90 million people are likely to fall below the extreme poverty threshold during 2020-2021, with the pandemic wiping out progress made in reducing poverty over the past two decades.

The IMF forecast a 2020 global contraction of 3.5%, an improvement of 0.9 percentage points from the 4.4% slump predicted in October, reflecting stronger-than-expected momentum in the second half. It predicted global growth of 5.5% in 2021, an increase of 0.3 percentage points from earlier, citing expectations of a vaccine-powered uptick later in the year and added policy support in the U.S., Japan and other large economies.

Read more

Source: Read Full Article