The restructuring will entail a merger and then demerger of each business into the respective family holding company

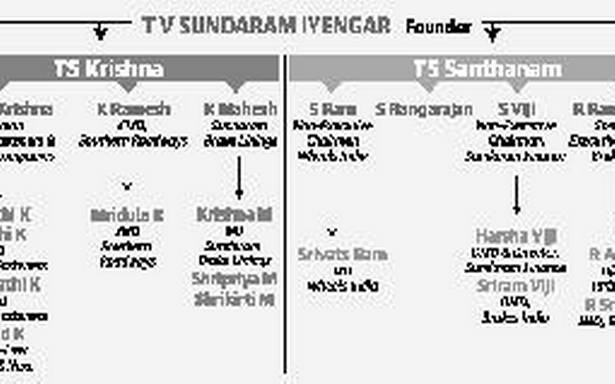

Story so far: The TVS group has existed for 110 years. Given the various businesses in the group and the interests and priorities in the third and fourth generations of its founder T.V. Sundaram Iyengar, the family has decided to align the ownership of different group companies with the respective arms of the families managing them. A look at the background and some details of the planned structure:

What is the first step of the family arrangement?

The group has primarily three holding companies — T.V. Sundram Iyengar & Sons Ltd. (referred to as TVS & Sons), Sundaram Industries Private Ltd. (SIPL) and Southern Roadways Private Ltd. (SRPL), referred to as TVS Holding Companies.

TVS & Sons holds majority stake in both the other holding companies and the balance in those two is held by the respective arms of the TVS family. Together, these three firms have funded, and hence hold stakes in, the group companies that have emerged over the years.

The first step of the arrangement is to merge SIPL and SRPL into TVS & Sons on a share exchange ratio based on valuation. Such a merger is necessary as different family arms run different businesses whose stakes are held variously by the 3 holding firms. A merger and then demerger of each business into the respective family holding company would follow.

Family arms also own a piece of the distribution business pertaining to their part of the overall business, which would be demerged into their ownership as part of the process.

At the end of the family arrangement, there would be no single holding company but there would be separate holding companies for each of the family branches that have been managing the respective businesses for decades, sources close to the family said.

Would there be other agreements that family members would enter into?

The sources said that additionally, the arrangement will probably also see a number of ancillary agreements — for example as to how the TVS brand would be used in the future, and a non-compete agreement — as has been the practice for decades in prior family partitions in our country.

What changes would the group’s listed firms witness?

While the companies that run the businesses themselves are not directly part of the family agreement, their holdings will witness a change. TVS Motor Company is run by Venu Srinivasan and his immediate family members. According to an exchange filing by TVS Motor on January 27, the TVS holding companies hold 63.76% in Sundaram Clayton (SCL), which is the holding company for TVS Motor.

It added that after the merger of the holding companies of the group, the two-wheeler auto parts and die castings business would be demerged into TVS Investments and Holdings Pvt. Ltd. (TVSIHPL). Also, the 63.76% of SCL’s shares held by the TVS Holding Companies will vest with TVSIHPL, in which Mr. Srinivasan and his immediate family members hold a majority stake.

Likewise, Sundram Fasteners, run by Suresh Krishna and his family, would witness a demerger of the fasteners business from the TVS Holding Companies into TVS Sundram Fasteners Pvt. Ltd. The 49.53% shares held by the Holding Companies in Sundram Fasteners will vest with TVS Sundram Fasteners Pvt. Ltd., in which Mr. Krishna’s family holds a majority.

Similarly, K. Mahesh’s family runs Sundaram Brake Linings, in which the TVS Holding Companies hold 32.66% stake. Post merger of the three TVS Holding Companies, a demerger of the Brake Linings business will be effected to Madurai Alagar Enterprises Pvt. Ltd. (MAEPL). So, the 32.66% of Sundaram Brake Linings held by the holding companies will vest with MAEPL, in which Mr. Mahesh’s family holds a majority.

TVS Investments (TVSI) holds 59.84% in TVS Electronics, run by Gopal Srinivasan and family. The TVS Holding Companies hold 85% stake in TVSI. TVSI will merge into this family’s holding firm Geeyes Family Holdings Pvt. Ltd. (GFHPL) and the stake held by the TVS Holding companies will vest with GFHPL.

The TS Rajam and TS Santhanam families would only have one holding firm each that would hold stakes in the companies they respectively manage. The TS Santhanam family’s holding company is Sundaram Santhanam & Family Pvt. Ltd. (SSFPL). The 29.69% of the TVS Holding Companies’ stake in Wheels India will vest with SSFPL. Brakes India is held partly by TVS & Sons, Southern Roadways and Sundaram Industries. Post merger of the holding firms, their entire holdings in Brakes India will move into TVS & Sons. Via the demerger, TVS & Sons’ holdings in Brakes India will come to the holding firm of Mr. Santhanam’s arm of the family, as would Sundaram Motors and Madras Auto Service, which are divisions within TVS & Sons.

As per the arrangement, the tyre business, the TVS division of TVS & Sons and TVS Logistics would go to the TS Rajam family.

At the end of the exercise, all shareholders of the TVS Holding Companies shall hold equity shares in the respective family arm’s holding firms, but the family which runs the business would own majority in the respective family holding firms.

How was ‘fair value’ found?

“It is a family settlement – an established principle of law,” sources said. “To preserve family harmony and make sure there are no disputes in the future, you can make family settlements.” among relatives by distributing assets. There is no buying or selling of shares. This is not a sale-purchase transaction. There is no share swap,” the sources added, pointing out that it would be difficult to explain ‘fair value’ in a family context. “There are so many factors and family history which go into it, so that linking the value of business to the settlement is impossible. It is not that the business value does not matter but it is just a lot more complicated,” the sources said.

It is expected that the TVS family arrangement would also involve certain cash payments between branches of the family, inter-se. Some family members, running businesses that are relatively more successful than others, would end up paying more cash.

Asked if he would like to comment on the topic of the family arrangement, Mr Suresh Krishna, Chairman, Sundram Fasteners, said, “We have decided in the family that the relevant information about the family settlement is in the published material.

Source: Read Full Article