Without naming Pawar or his kin, the tax authority said evidence gathered by the department during the raids carried out at about 70 premises across Mumbai, Pune, Baramati, Goa and Jaipur has revealed “several prima-facie unaccounted and benami transactions”.

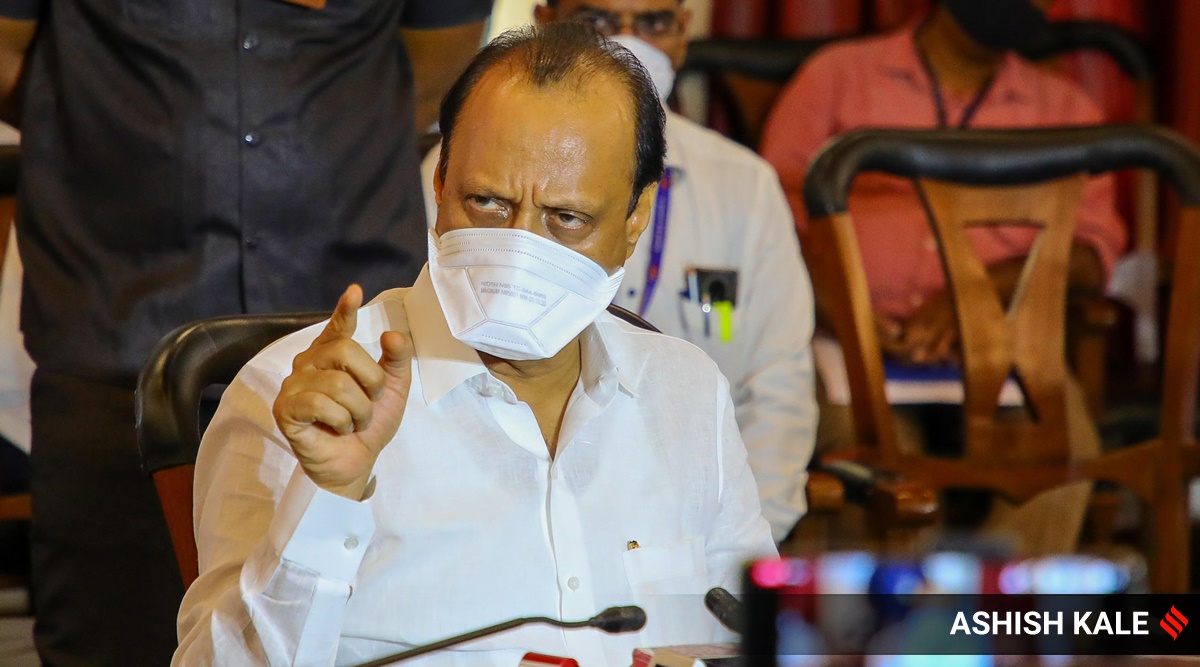

The Income Tax Department (I-T) Friday said during its searches on October 7 it unearthed unaccounted income of Rs 184 crore of two Mumbai-based real estate groups that are linked to the family of Maharashtra Deputy Chief Minister Ajit Pawar.

Without naming Pawar or his kin, the tax authority said evidence gathered by the department during the raids carried out at about 70 premises across Mumbai, Pune, Baramati, Goa and Jaipur has revealed “several prima-facie unaccounted and benami transactions”.

“Incriminating documents, evidencing unaccounted income of about Rs 184 crore of the two groups have been found,” said the tax agency in a statement Friday.

On October 7, the tax agency searched a firm where Ajit Pawar’s son Parth is a director, a few firms owned by Pawar’s sisters, two real estate firms linked to Pawar and directors of four sugar mills across the state indirectly linked to the Pawar family.

On the day of the tax searches, Ajit Pawar had said he had no problem with the searches against him but was upset that his sisters had been dragged into it. “We pay taxes every year. Since I am the Finance Minister, I am aware of fiscal discipline. All entities linked to me have paid taxes,” he said.

“I am upset because (premises of) my sisters, who got married 35 to 40 years ago, have been raided. If they were raided as Ajit Pawar’s relatives, then people must think about it…the way the agencies are being used,” he said, adding, the tax department is in a better position to say if there was a political angle to the searches.

The tax department has claimed it has found the two real estate companies infused unaccounted funds through “suspicious” transactions with the involvement of the family of Ajit Pawar.

“The search action has led to identification of transactions by these business groups with a web of companies which, prima facie, appear to be suspicious. A preliminary analysis of the flow of funds indicates that there has been an introduction of unaccounted funds in the group by way of various dubious methods like introduction of bogus share premium, suspicious unsecured loans, receipt of unsubstantiated advance for certain services, collusive arbitration deals out of non-existent disputes, etc. It has been observed that such suspicious flow of funds has taken place with the involvement of an influential family of Maharashtra,” said the I-T department in its statement.

According to the tax department, the unaccounted funds have been used for “acquisition of various assets such as office building at a prime locality in Mumbai, flat in posh locality in Delhi, resort in Goa, agricultural lands in Maharashtra and investments in sugar mills”.

“The book value of these assets aggregates to about Rs 170 crore,” said the tax authority.

Apart from this, the I-T department has also seized unaccounted cash of Rs 2.13 crore and jewellery worth Rs 4.32 crore from the two real estate groups during the tax searches.

Source: Read Full Article