‘Investors don’t have to worry about underperformance in passive funds, which earn market-equivalent returns.’

In an effort to expand the reach of passive investing, the Securities and Exchange Board of India is reportedly contemplating a relaxation of regulatory constraints for mutual fund houses that only offer passive funds.

This shift could potentially open the door to a new wave of entrants, sparking a significant expansion in passive investing in India.

The latest S&P Indices Versus Active (SPIVA) India report (for end of 2022) is also out.

It once again confirms that active fund managers are struggling to beat the benchmark in several categories.

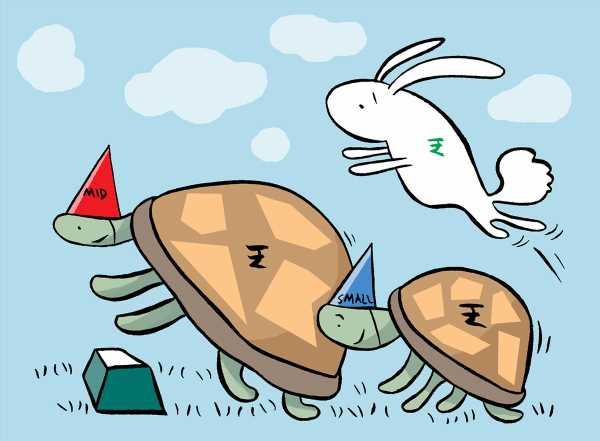

Over the past 10 years, 67.9 per cent of large-cap active funds, 63.9 per cent equity linked savings schemes (ELSS) and 50 per cent of mid-cap and small-cap active funds have failed to beat the benchmark.

Strong case for passive funds

Successive SPIVA reports have demonstrated this trend of underperformance by active funds (in some segments) for a considerable period now.

“Research done by S&P some time ago has also shown that past data doesn’t provide any indication regarding which funds will outperform over the next five years,” says Avinash Luthria, a Sebi-registered investment advisor and founder, Fiduciaries.

These two points — underperformance by a significant number of active funds and difficulty in predicting future winners — creates a case for investing in passive funds.

Simplify investing

When investors opt for active funds, they expose themselves to the risk of underperformance by the fund manager.

“This could happen due to incorrect sector and stock selection. This risk is controlled by going passive,” says Vishal Dhawan, chief financial planner, Plan Ahead Wealth Advisers.

Investing becomes simpler with passive funds.

“Investors don’t have to worry about underperformance in passive funds, which earn market-equivalent returns. In active funds, many investors pick funds based on past returns. Those that have done well in the past few years often witness a phase of underperformance,” says Deepesh Raghaw, Sebi-RIA and founder, PersonalFinancePlan.

“The investor then hops to another fund that is doing well currently. Such constant hopping compromises investment discipline,” he adds.

Since passive funds don’t underperform, sticking to them for long periods is easier. Passive funds also have lower expense ratios.

According to Luthria, investors who opted for active large-cap funds and happened to be in the bottom quartile in terms of performance over the past 10 years would have cumulatively underperformed the index (BSE 100 Total Return Index) by 17 per cent or 1.8 per cent annually.

“That is the kind of risk investors potentially run when they opt for active funds,” he says.

Don’t fall prey to FOMO

A set of active fund managers will outperform the index every year.

Passive fund investors could fall prey to FOMO (fear of missing out) and exit their passive holdings.

Investors could subject themselves to concentration risk if they opt for narrowly-focused index funds.

Also, remember that the performance of passive funds with high tracking error will diverge considerably from that of the index.

Go passive in a few segments

The case for passive funds is particularly strong in a few segments.

“Fund managers struggle to beat the index particularly in the large-cap and international segments,” says Dhawan.

According to the SPIVA India scorecard, 63.9 per cent of ELSS have failed to beat the benchmark over the past 10 years.

“Those in the old tax regime may invest in a passive ELSS, now that a couple have become available,” adds Dhawan. On the debt side, he suggests target maturity funds.

Building a passive portfolio

Split your equity portfolio into core and satellite.

“The core portfolio should aim to earn market-equivalent returns. Here, you may opt for a Nifty50 or Nifty 100 based fund,” says Raghaw.

Investors who want geographic diversification and are okay with slightly lower post-tax returns from international funds after the recent change in tax norms may opt for an S&P 500 or a US all-market fund.

Go for an 80:20 split between domestic and international funds.

In the satellite portfolio, you may try to beat the markets.

Include actively managed funds, sector or thematic funds, factor-based funds and passive mid- and small-cap funds here.

- MONEY TIPS

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Source: Read Full Article